This week, global financial markets moved in response to a tug-of-war between fresh tariff threats and surprisingly resilient risk appetite. While Wall Street flirted with new highs before backing off on Friday, spooked by talk of a 35% U.S. tariff on Canada and Brazil, Asia’s major bourses and most European indices logged cautious gains as solid tech earnings helped offset trade anxieties.

Investor sentiment remained bifurcated, risk-on toward growth assets such as Big Tech and Bitcoin, but risk-off in safe-havens like the dollar and Treasuries, especially after Washington’s hawkish tone on both trade and rates.

Across asset classes, oil rallied on an IEA warning that supply may be tighter than it looks, gold clung to support despite a firmer greenback, and Bitcoin stormed to yet another record above $118k on blockbuster ETF inflows. The result: broader markets ended the week mixed, but volatility crept higher as investors weighed geopolitics, policy path, and the prospect of mid-summer liquidity thinning out.

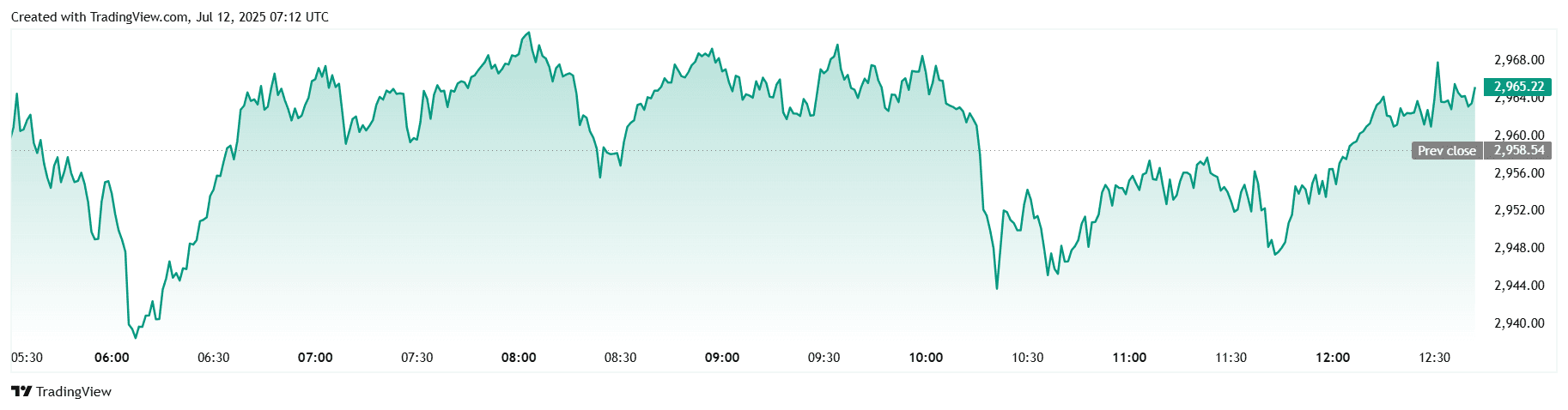

🟨 Equities Roundup

Equity Markets React to Tariff News & Tech Earnings

Key index performance:

-

S&P 500 saw record highs early in the week hit ~6,290 on July 10 before a slight dip to ~6,266 by July 11–12.

-

Nikkei and FTSE 100 generally climbed, driven by tech strength and supportive earnings across sectors (exact levels largely flat to modestly up).

-

Nifty 50 tracked broader Asia, posting moderate weekly gains.

Major winners/losers:

-

Big Tech led the charge, boosting U.S. equities.

-

Conversely, Energy sector lagged, FactSet noted earnings in that sector fell YoY.

Regional trends:

-

U.S. equities ended the week at or near all-time highs amid easing inflation concerns and upbeat earnings.

-

Europe showed modest gains with caution ahead of ECB signals.

-

Asia, led by Japan and India, followed the global risk-on tone.

Drivers:

-

Tariff concerns, specifically, a U.S. 35 % tariff on Canada briefly rattled markets.

-

Solid tech earnings and 9 % expected S&P 500 EPS growth fueled investor confidence.

🟩 Commodities Check

Oil Climbs While Gold Finds Support

- Crude oil: Brent surged ~3% over the week, driven by the IEA’s tighter supply outlook and geopolitical risks.

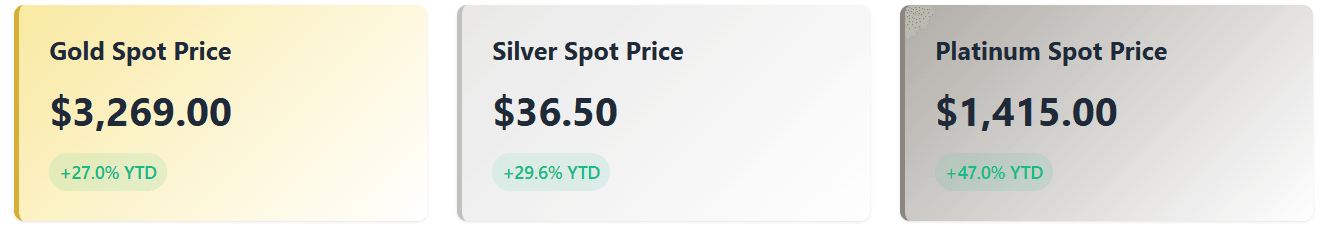

Gold & precious metals:

-

Gold consolidated around $3,269/oz after recent highs (~$3,499).

-

Silver rallied to ~$36.50, its highest in 13 years.

-

Platinum jumped ~10% to ~$1,415, an 11-year peak.

-

Tin, nickel, and zinc showed mixed trends but were broadly supported by bullish global demand.

Influences:

-

OPEC+ outlook plus summer demand tightening in oil.

-

Inflation-driven safe-haven flows and U.S. dollar weakness buoyed metals.

Key price zones:

-

Gold support near $3,200–3,250; silver resistance around $37.

-

Brent technical resistance approaching ~$80/barrel on tight supply outlook.

##🟦 Currency & Forex Snapshot Dollar Strengthens Amid Tariff Tensions

- DXY index: Rose to ~97.8 by July 11, climbing above 97.6 following U.S. tariff threats.

Major currencies:

-

EUR/USD slipped below 1.1700.

-

GBP and JPY weakened amid risk-off sentiment.

-

INR remained stable, mildly pressured by dollar strength.

Drivers:

-

Flare-ups in U.S.–Canada tariff talk drove haven demand.

-

Risk-off tone from global trade uncertainty gave the dollar a boost.

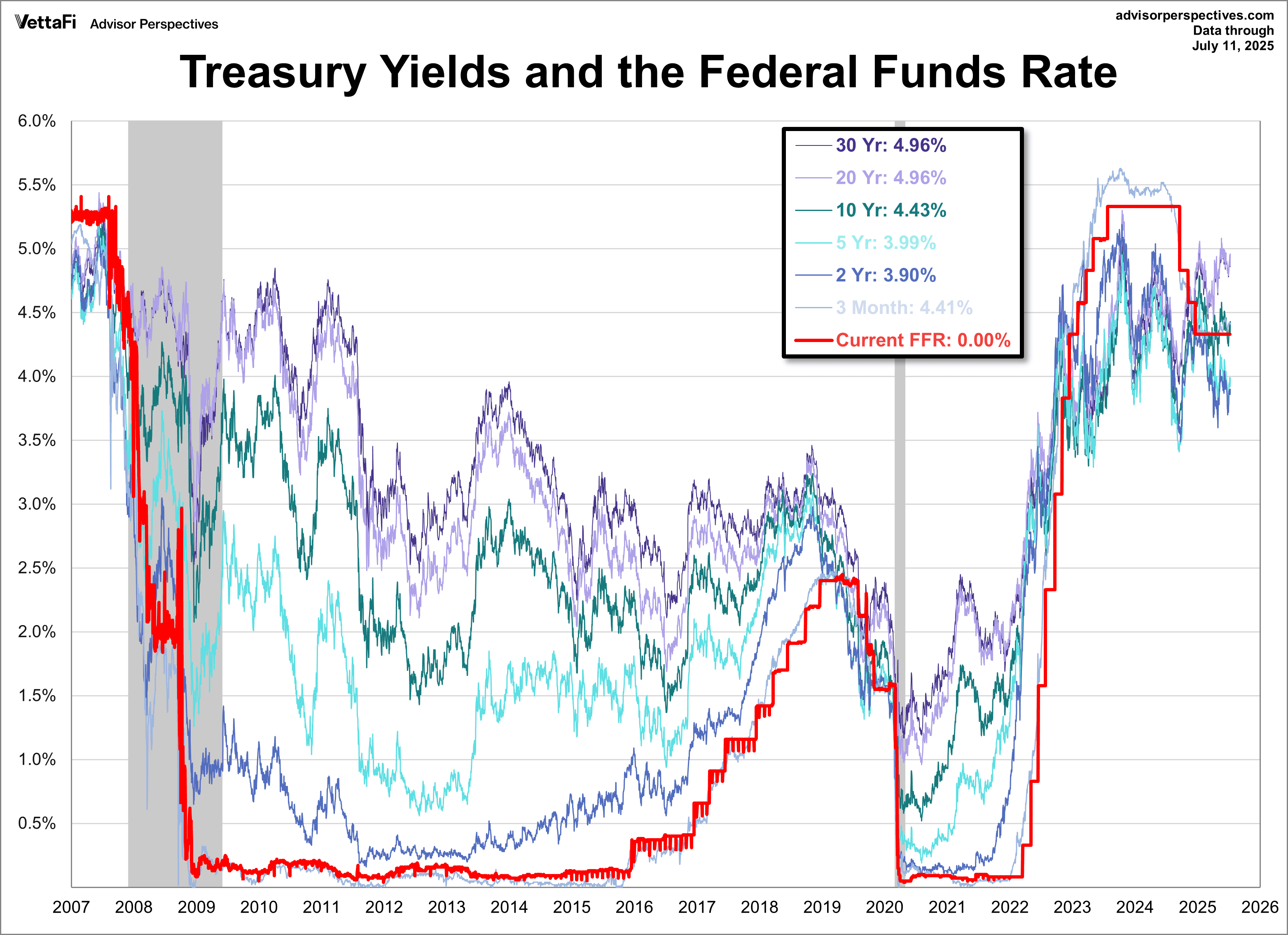

🟥 Bond Yields & Interest Rates

Yields Rise on Hawkish Fed Signals

- 10‑year Treasury yield: Climbed from ~4.40% to 4.43% by July 11. 2‑year at ~3.90%, 30‑year near 4.96%.

-

Central bank commentary: Fed maintains 50 bp projected cuts in 2025, but outlook for July cut is weak (~11%). ECB urging clear communication, while BoE warns on politicization of Fed messaging.

-

Inflation bond influence: Despite cooling data, yields edged up amid tariff worries and fiscal uncertainty.

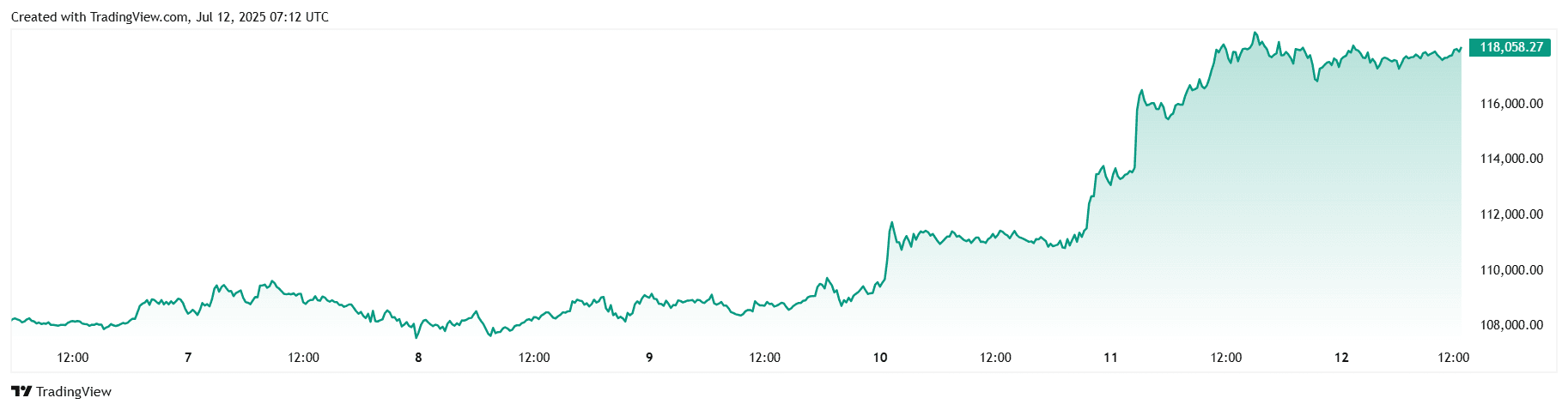

🟪 Crypto & Alternative Assets

Bitcoin Holds Firm, Altcoins Volatility Returns

-

Bitcoin (BTC): Hit new record highs up to ~$118,000 backed by strong ETF inflows ($1.18 bn in) and short squeeze.

-

Ethereum (ETH): Gained over 16% in five days, supported by growing institutional exposure.

-

PENGU, BONK, FARTCOIN surged spectrally.

-

Positive sentiment ahead of U.S. “Crypto Week” (July 14–18).

-

Institutional momentum and regulatory clarity fueling crypto strength; altseason perhaps underway.

##🔶 Global Events & Macro Trends U.S. Tariffs Roil, Crypto Week Ahead

Economic data:

-

U.S. inflation cooling, stable unemployment (~4.1%), and June PMIs flagged moderation.

-

PMI around weakness in business activity noted.

Global headlines:

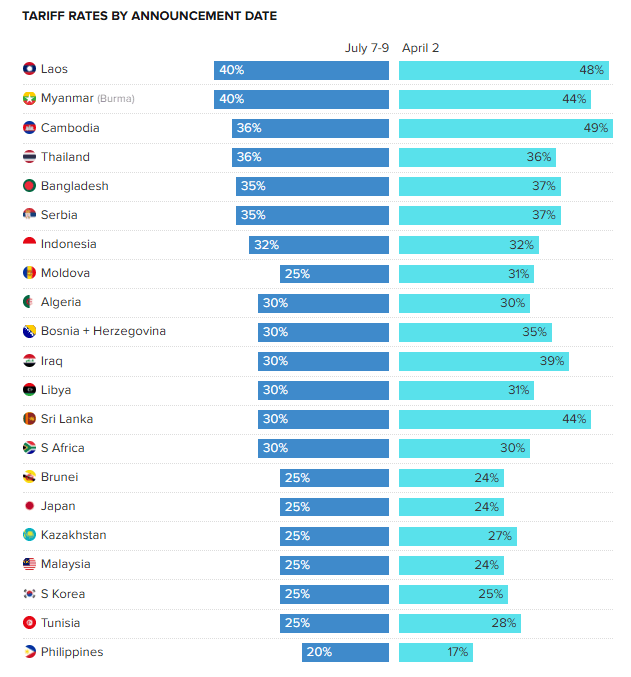

- Trump’s proposed tariffs on Canada (35%) and Brazil raised fears of a full-blown trade war. Trump also announced new tariff rates for 21 nations.

- U.S. Congress branding Crypto Week (July 14–18) signals potential regulatory clarity.

Closing Thoughts

Looking at the broader picture, markets appear to be drifting rather than decisively trending, with tariff uncertainty anchoring sentiment. Tech and crypto showed unambiguous strength, yet rising bond yields and a surging dollar signal that inflation-inflamed policy risks have not vanished. Energy equities, oddly, failed to capture crude’s three-percent weekly pop, highlighting rotation fatigue, while defensives and small-caps lagged suggesting investors are still clustering in a few perceived safe stories.

Heading into next week, all eyes will be on the U.S. CPI release and the Fed’s July minutes, followed closely by China’s Q2 GDP print and the start of “Crypto Week” on Capitol Hill. A soft inflation read could reignite the bid for duration and equities alike; a hot print would likely deepen the rate-sensitivity we saw in Treasuries above 4.4 %. Meanwhile, any concrete progress on crypto legislation could either validate Bitcoin’s institutional thesis or spark a classic “sell the news” pullback after its vertical run.

Bold take: If trade rhetoric escalates but hard data stay benign, we may witness a rare pairing, equities grinding higher alongside the dollar and long yields until one of those “safe” signals blinks. For nimble investors, that could be a cue to hedge high-beta winners and accumulate quality cyclicals poised to benefit from a late-summer rerating.