Stocks punched through record highs this week even as oil prices fell off a cliff, underscoring how sharply narratives can diverge across asset classes.

AI-led tech momentum and a rush of overseas inflows lifted U.S. and Asian benchmarks, while Europe eked out smaller gains. In commodities, whispers of an OPEC+ supply bump pushed Brent and WTI to their worst weekly drop in nearly two years, dragging energy shares lower. A softer-than-feared U.S. core-PCE print helped nudge Treasury yields and the dollar down, reviving “earlier-cut” chatter and giving risk assets even more oxygen. Meanwhile, Bitcoin flirted with new cycle highs as traders debated whether the surge in BTC dominance is clearing the runway, or crowding it, for a fresh alt-season.

Here’s the cross-asset scorecard for 23 – 29 June 2025 and the forces that shaped it.

🟨 Equities Round-up

Equity Markets Push to Record Highs Despite Tariff Jitters

-

The S&P 500 closed Friday at a record 6,173 (+2.4% w/w) while the Nasdaq hit a fresh high, powered by AI chips (Nvidia +1.8%) and Nike’s 15% surge on upbeat revenue guidance. Energy lagged as crude slumped.

-

The FTSE 100 eked out a 0.4% weekly rise to 8,799, helped by defensives even as sterling strength capped exporters.

-

Japan’s Nikkei vaulted back above 40,000 for the first time since January, finishing the week up 3% on easing tariff worries and a US-China rare-earth pact.

-

The Nifty 50 advanced 2.4% to a record 25,638 as FII inflows returned; gainers included Jio Financial (+3.5%) and ICICI Bank (+1.6%).

-

HDB Financial’s US $1.5 bn IPO drew 2× demand, while Micron’s upbeat forecast revived AI-hardware sentiment.

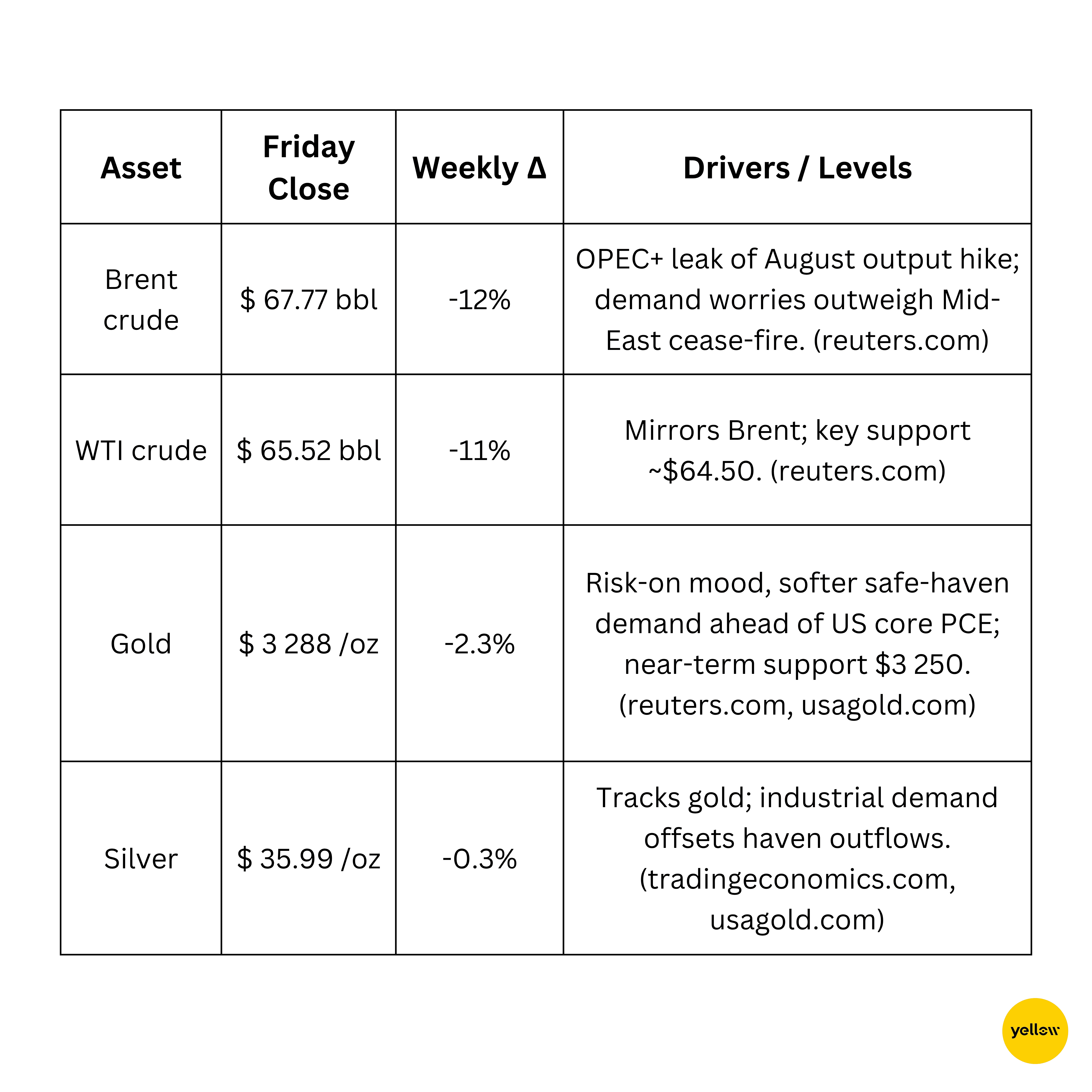

🟩 Commodities Check

Oil Slides 12 % on OPEC+ Supply Talk; Gold Softens

Copper steadied, holding the $8,800 t support as China signalled more stimulus for property-linked demand.

🟦 Currency & Forex Snapshot

Dollar Index Sinks to 3½-Year Low on Fed-Cut Bets

-

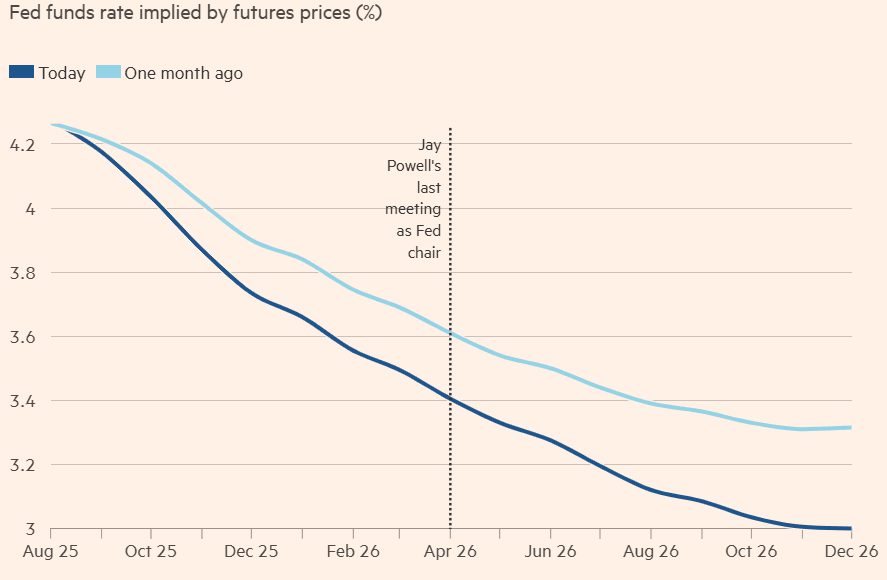

DXY: Slipped below 97.5 (-0.8% w/w) as traders price a dovish successor to Chair Powell and a 63 bp easing cycle starting September.

-

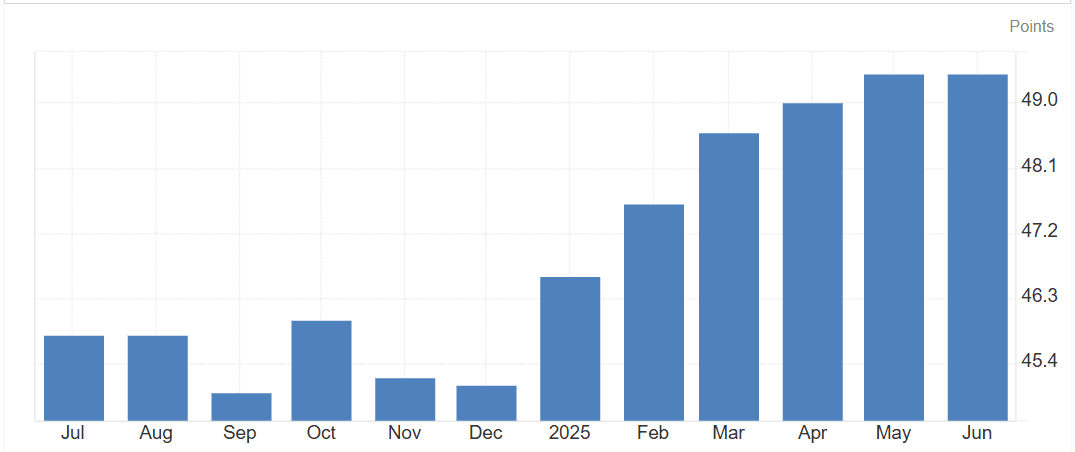

EUR USD: Firmed to 1.17, buoyed by better-than-expected Eurozone flash PMIs and fading rate-cut odds beyond July.

-

USD JPY: Yen strengthened to 144.6 from 147 amid lower US yields and month-end exporter flows.

-

USD INR: Rupee rallied 0.7% on hefty FII equity inflows, finishing 85.48.

🟥 Bond Yields & Interest Rates

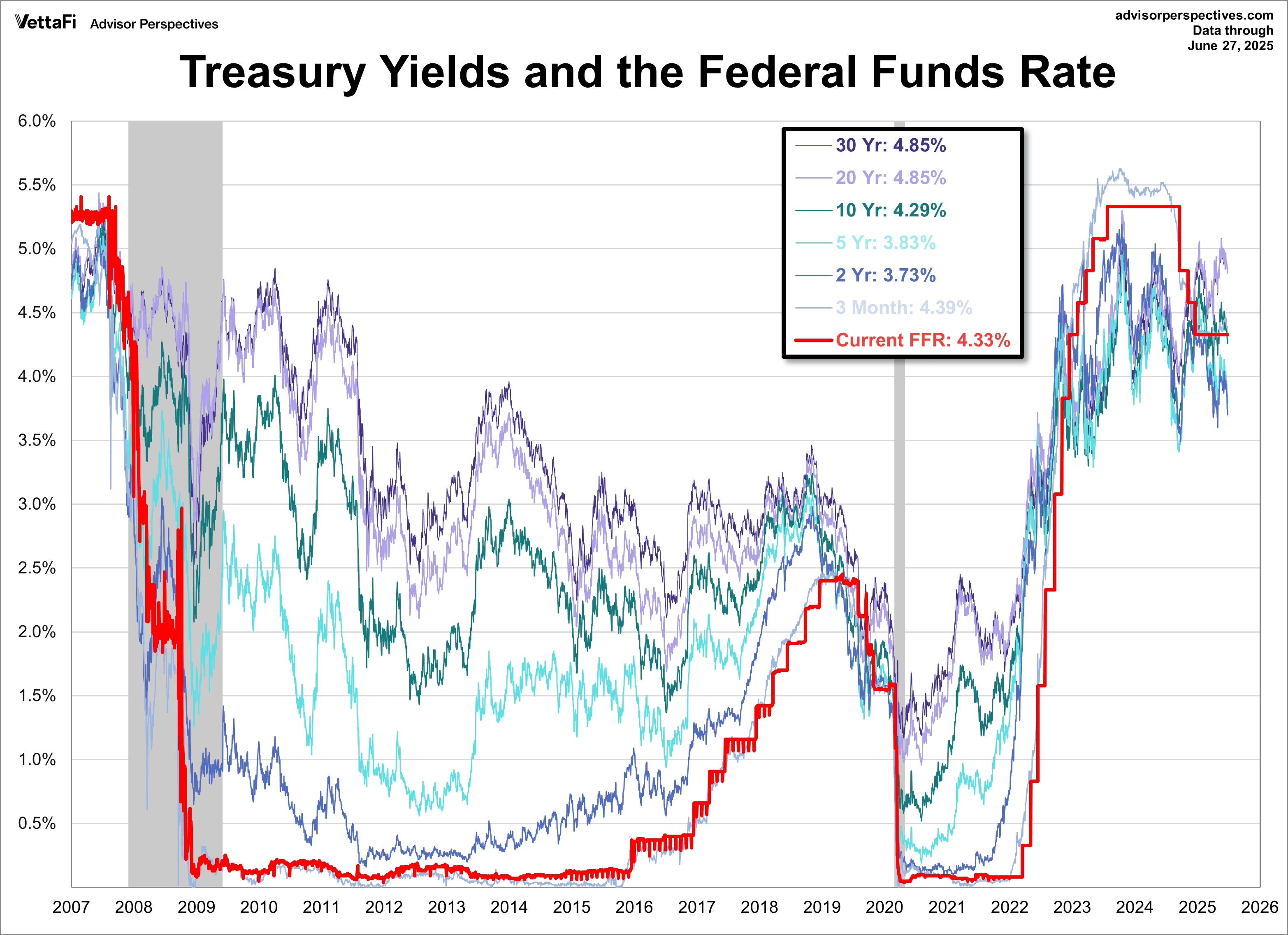

Global Yields Dip as Markets Smell More Cuts

- US 10-yr ended at 4.39% (-6 bp w/w) after President Trump said his next Fed chair “must favour rate cuts,” reinforcing futures that now price >50 bp in 2025.

- 2-yr/30-yr is at 3.30% and 4.85%, flattening the curve modestly.

-

In the Euro area, Bund yields slipped 3 bp to 2.18% as Lagarde signalled a pause after June’s cut.

-

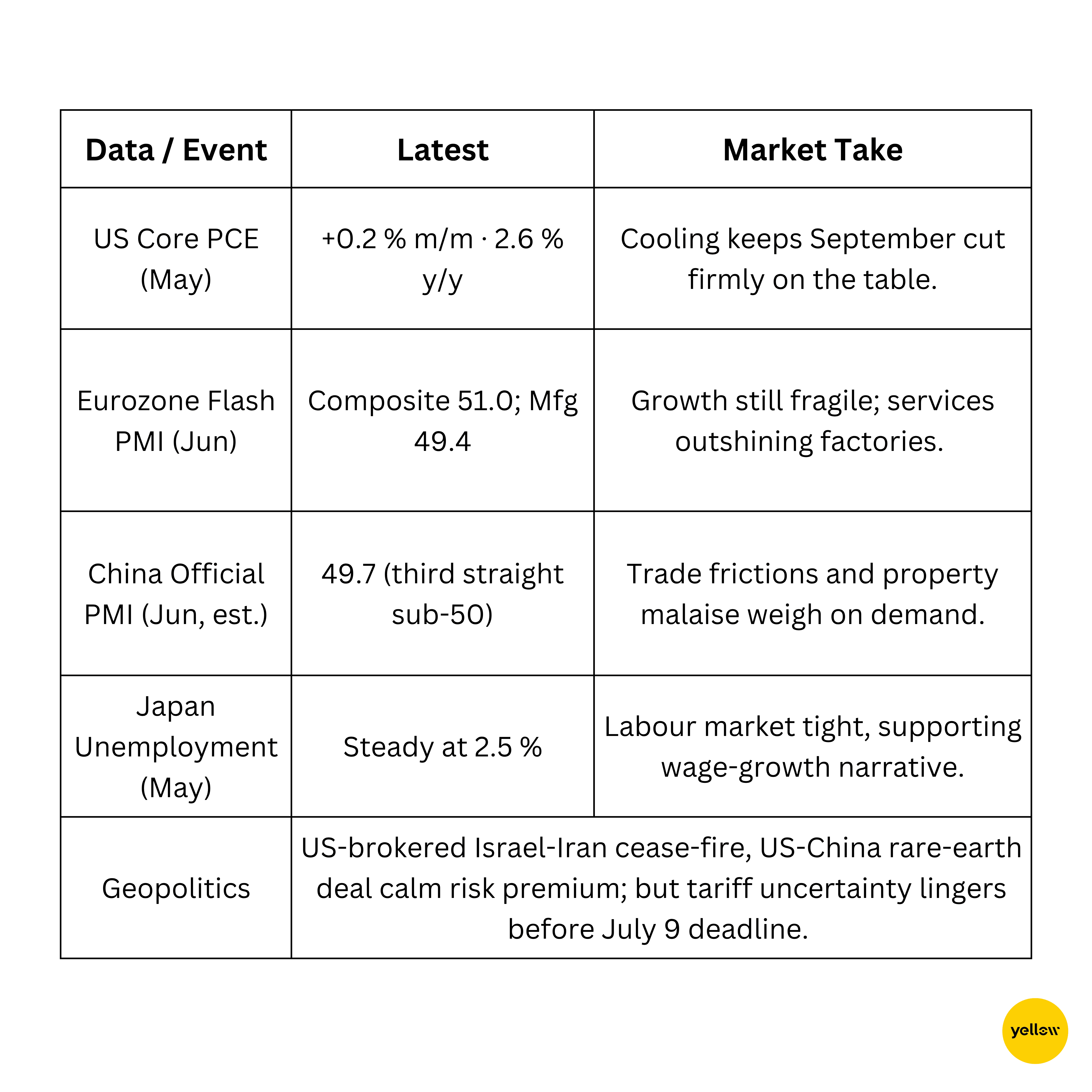

US core PCE rose 0.2 % m/m, still above target, keeping July cut odds slim.

🟪 Crypto & Alternative Assets

Bitcoin Brushes $108 K; Policy Tailwinds, Security Headwinds

-

Prices: BTC $107.4 K (+1.4% w/w); ETH $2 427 (-0.7%). Total crypto m-cap $3.29 tn.

-

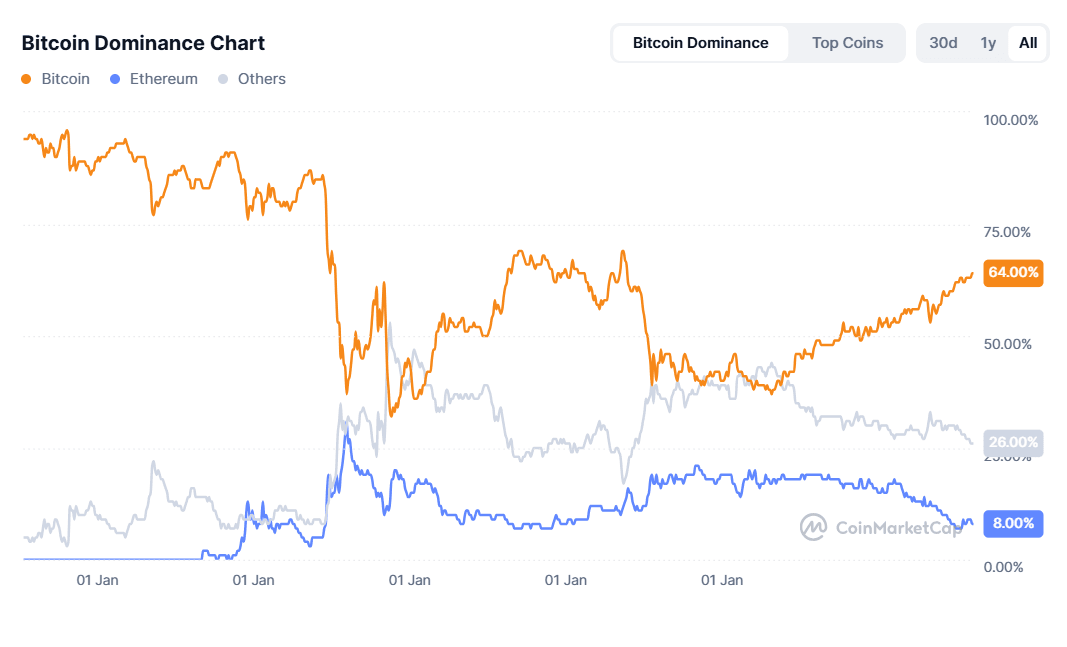

Macro theme: BTC dominance at 64% sparks chatter of an “alt-season” as investors rotate into high-beta plays (watch Arbitrum, Bonk, Sonic).

-

Regulation: US Senate passed the GENIUS Act, the first stable-coin framework, requiring monthly reserve disclosures.

-

Security: H1 crypto thefts hit a record $2.1 bn, led by North Korea’s $1.5 bn Bybit exploit, fuelling demand for on-chain insurance.

🔶 Global Events & Macro Trends

Mixed Macro Signals; China Softens, US Inflation Cools

Closing Thoughts

The last week of June delivered risk-on equity records even as crude suffered its sharpest weekly loss in two years. Falling real yields, a bruised dollar and hopes of friendlier central-bank appointments underpinned global risk appetite. Yet divergences are widening:

-

Sector rotation: AI hardware and consumer discretionary lead US gains, whereas oil majors retreat alongside crude.

-

Regional dispersion: Japan and India continue to outpace Europe as tariff détente benefits Asia’s exporters and FII flows chase high-growth EMs.

-

Cross-asset signals: Softer gold and bond yields echo ebbing safe-haven demand, but ballooning crypto hacks and China’s under-50 PMI keep tail-risk premiums alive.

With key Q2 earnings and the July 9 tariff deadline looming, traders head into July balancing liquidity-fuelled momentum against policy landmines. Stay nimble — the summer narrative could pivot quickly from “breakout” to “shake-out.”