Global markets spent the week walking a tightrope between relief and anxiety. Washington’s appeals-court stay kept President Trump’s “Liberation Day” tariffs alive, re-injecting trade risk just as investors were cheering a cooler U.S. PCE print and the S&P 500’s best month since 2023. While Wall Street rotated into AI chips on Nvidia’s blockbuster outlook, sentiment in Asia sagged: factory gauges hinted at another sub-50 reading for China’s PMI and Japanese equities buckled under auto-export fears.

Europe juggled a stronger-than-expected U.K. inflation surprise with talk of faster BoE easing, leaving sterling firm but rate-cut timing foggy. Commodities told a similar two-track story: OPEC+ pushed ahead with a fresh July supply hike, capping crude’s bounce, while Australian retail weakness and soft U.S. spending data fanned hopes that global disinflation still has legs.

Equities Roundup

Equity Markets React to Tariff Whiplash & Mixed Macro Data

-

United States: The S&P 500 gained ≈1.9% on the week, closing at 5,912, barely 3.8% shy of February’s record, underpinned by AI-chip strength even as tariff headlines stirred intraday swings. The Nasdaq’s 9.6% May surge was its best month since 2023.

-

Europe: London’s FTSE 100 slipped ≈0.1% to 8,772, with retailers such as JD Sports tumbling on tariff-exposure worries, while utilities out-performed on defensive flows.

-

Asia-Pacific: Japan’s Nikkei 225 fell 1.3 % across the week, ending at 37,965 after tech and auto stocks sold off when U.S. levies were reinstated.

-

India: The Nifty 50 eased 0.68 % to 24,751, dragged by auto names as investors booked profits after May’s rally. Navia

Notable movers & events:

-

Winners: U.S. semiconductors (Nvidia +4 % w/w) on AI server demand.

-

Losers: Asian automakers (Mazda −3.5 %, Kia −3.8 %) on tariff shock.

-

No major IPOs priced this week, but U.S. fiscal-reform headlines kept deal pipelines cautious.

Commodities Check

Oil Drifts Near $63 While Gold Cools From Record Highs

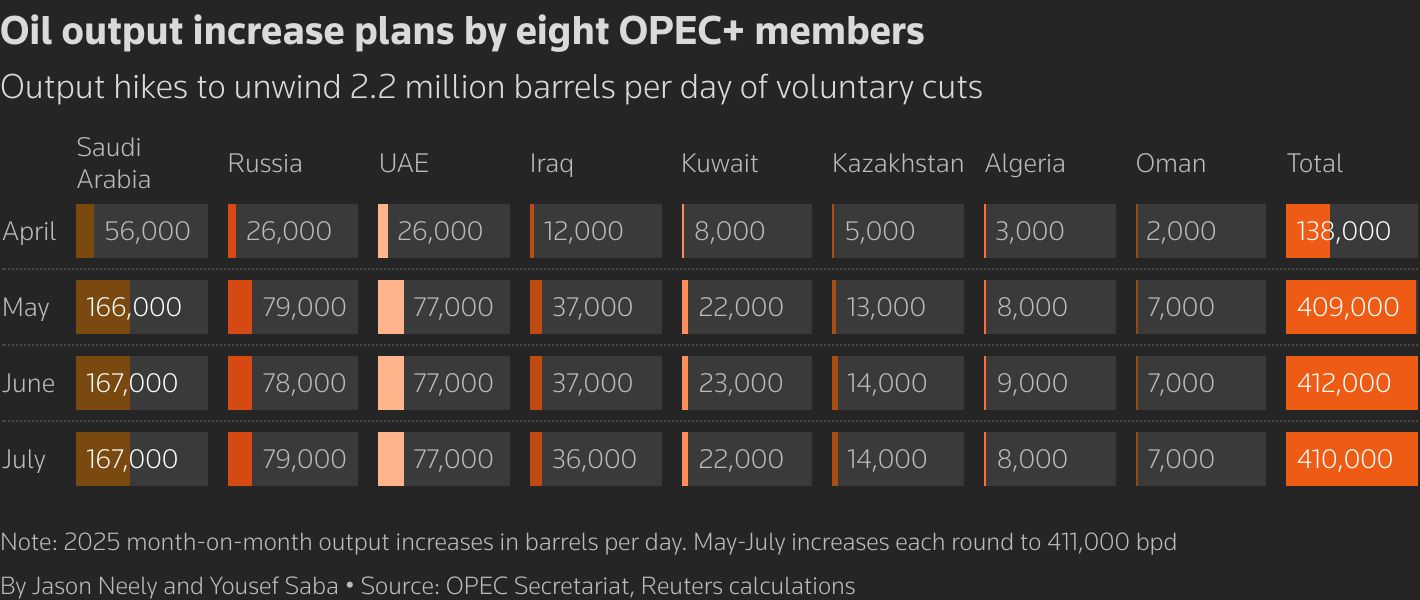

- Crude oil: Brent futures settled at $62.78 /bbl, down 0.9 % on the week as OPEC+ confirmed a fresh 411 kb/d July hike, prioritising volume over price.

-

Gold: Spot gold retreated to $3,289 /oz after touching $3,318 mid-week, snapping a three-week win streak as the dollar firmed. Silver held above $33 /oz.

-

Industrial metals & bulk: Thermal-coal benchmarks in Asia hit four-year lows after Indonesian exports slumped 12% YTD, undermining LNG bulls.

-

Key levels watched: Brent $60 (support) / $66 (resistance); Gold $3,250 (support) / $3,400 (resistance).

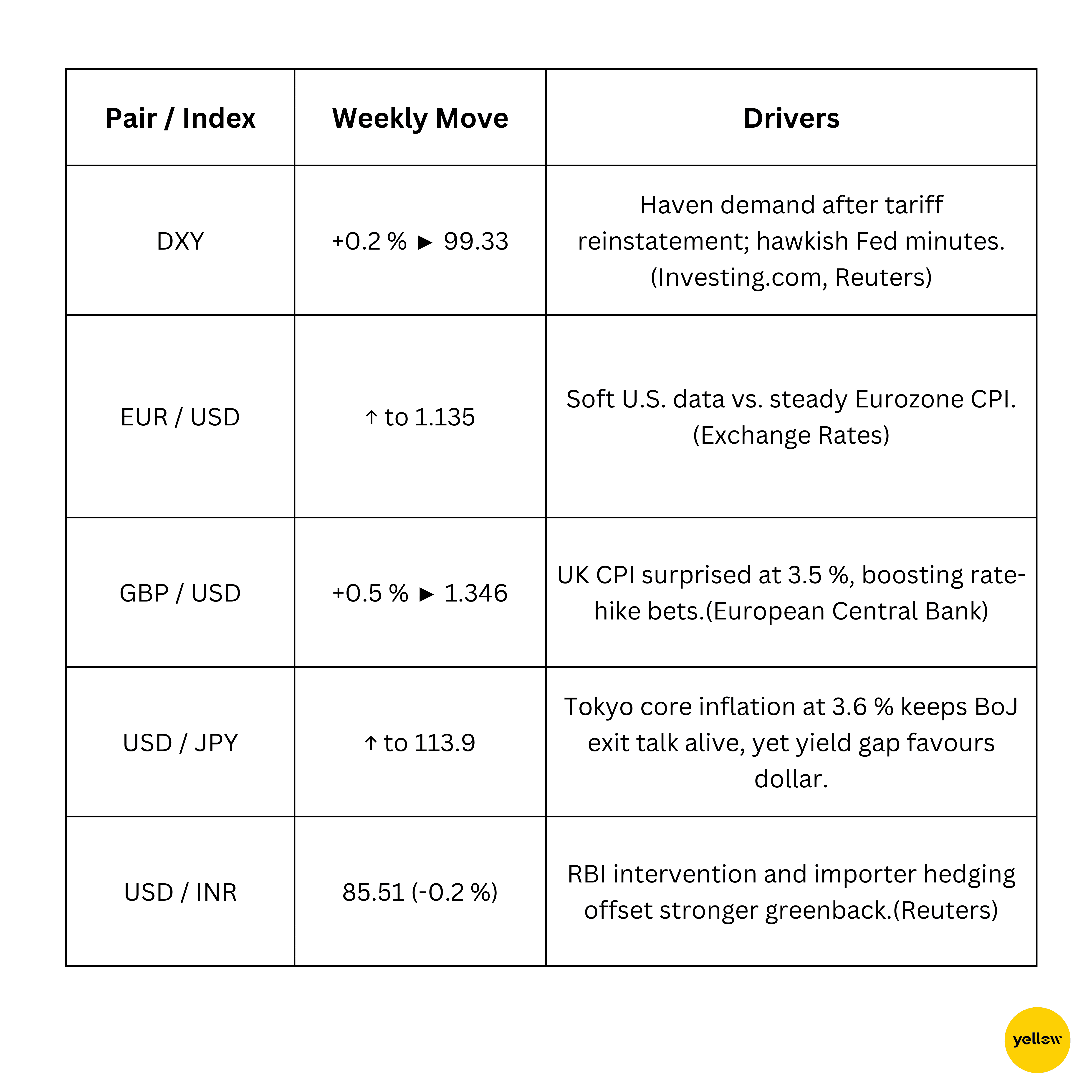

Currency & Forex Snapshot

Dollar Index Edges Higher; Sterling Pops on Hot UK CPI

Bond Yields & Interest Rates

Yields Grind Up After Hawkish Fed Minutes, ECB Stays Cautious

-

U.S. Treasuries: The 10-year yield ended the week at 4.41%, up ~6 bp, as minutes showed FOMC members conscious of “difficult trade-offs” between inflation and jobs.

-

Europe: German 10-year Bunds closed just above 2.50%, little changed as Eurozone inflation held at 2.1 %.

Crypto & Alternative Assets

Bitcoin Holds the $104 k Line; Altcoins Swing on Policy Headlines

-

Bitcoin (BTC): Down 2.1 % on the week, but rebounded above $104 k after tariff-driven liquidations wiped nearly $1 bn in longs.

-

Ethereum (ETH): Slipped to $2,633 (-1.8 % w/w) before buyers defended the $2,600 support.

-

Macro narrative: Vice-President JD Vance’s keynote at Bitcoin 2025 and the White House push for stablecoin legislation kept regulatory sentiment constructive, limiting downside.

Global Events & Macro Trends

Tariffs Cloud Trade Outlook; Diverging Inflation Paths

-

Taiwan’s central bank reassured markets that U.S. Treasuries remain a “sound” investment and the dollar’s reserve-currency crown is safe, cooling speculation about an imminent post-dollar order.

-

China’s official manufacturing PMI lingered below the 50-point expansion line at 49.5, underscoring a patchy recovery and fuelling calls for fresh Beijing stimulus.

-

The IMF warned that swelling global debt and opaque non-bank exposures threaten liquidity in the $80 trillion sovereign-bond market, urging policymakers to strengthen safeguards.

Closing Thoughts

Looking across asset classes, price action felt more rotation than retreat. Chipmakers, energy explorers and selected defensives drew flows, suggesting investors are neither abandoning risk nor embracing it wholesale. Autos and exporters remain the pressure points, and China’s sputtering PMI adds another headwind for cyclicals in the coming quarter. Macro prints delivered a mixed message: headline inflation is easing in the United States, yet sticky readings in the U.K. and Japan warn that the “last mile” of the disinflation journey will be hard-fought. The juxtaposition of rising policy divergence and resurgent trade tensions hints at choppier cross-asset correlations; yield curves are unlikely to find a stable anchor until clarity emerges on Fed timing and the tariff end-game.

Eyes now turn to next week’s U.S. non-farm payrolls and the official China PMI release. A soft jobs report paired with another sub-50 China reading could strengthen the odds of synchronized monetary support, an outcome that equity bulls would welcome. Conversely, any upside surprise in employment or a hawkish Fed tone could see the dollar extend its grind higher, tightening global financial conditions just as corporate earnings momentum shows early signs of peaking. In short, opportunity still exists in AI infrastructure, selective commodities and high-quality balance sheets but so do red flags around liquidity and policy missteps.