Bitcoin on Sunday evening staged a forceful rebound over the weekend, surging from levels below $88,000 to an intraday high of $91,767 and triggering a wave of liquidations across the crypto market.

The sharp reversal erased heavily leveraged positions as large buyers stepped in and absorbed sell pressure that had built during the recent downturn.

After briefly dipping toward the $87,000 range, Bitcoin reversed course with a strong burst of volume visible across lower timeframes.

What Happened

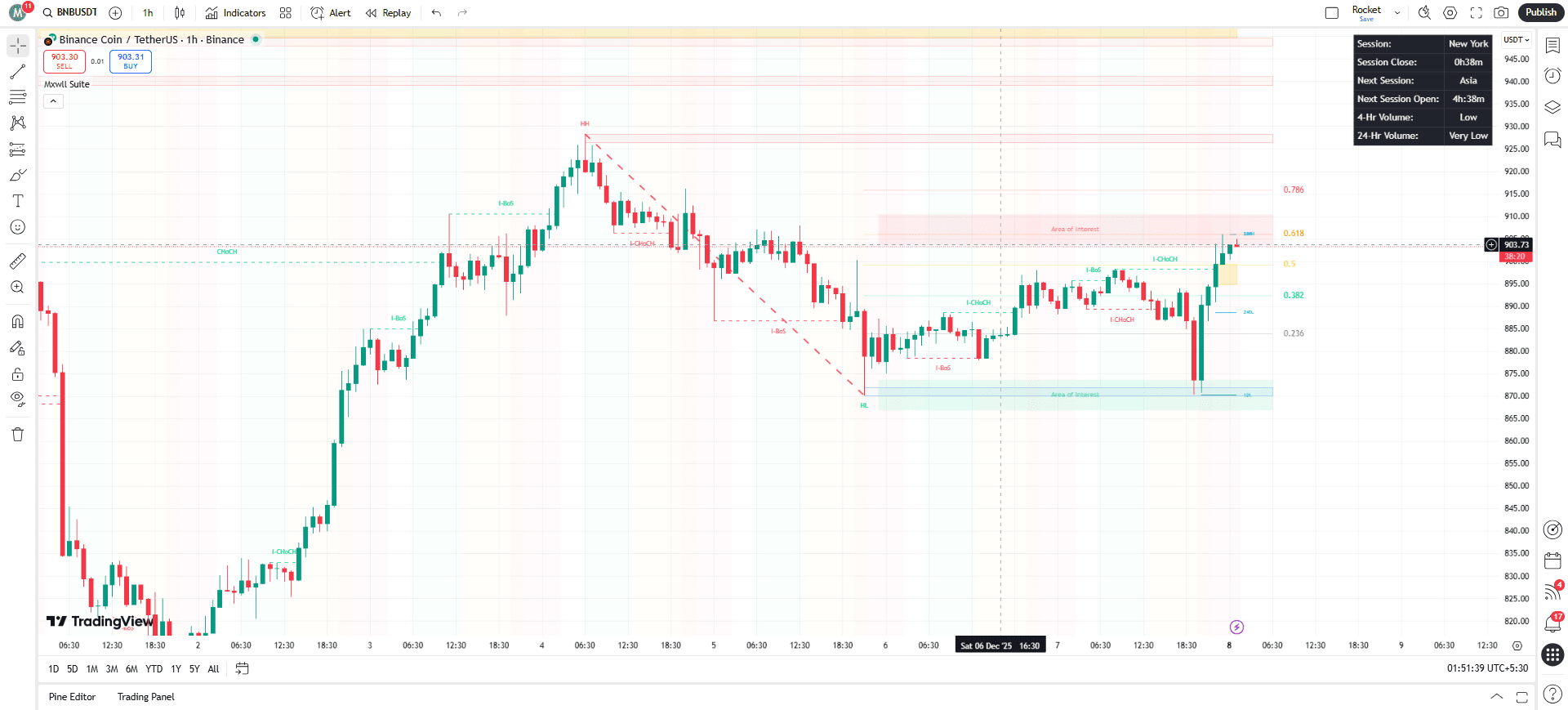

According to TradingView data, the one-hour chart showed a deep wick to roughly $87,784, followed immediately by aggressive buying that sent prices higher.

The uptick in volume indicated participation from larger players rather than retail traders, with orders soaking up available liquidity.

The four-hour chart reflected the same momentum shift, registering a prominent green candle supported by volume that exceeded previous sessions.

This marked the latest response to a week in which Bitcoin had fallen to a low near $80,537 before staging multiple recovery attempts.

As buyers stepped back in, the pattern of heavy candles and renewed demand suggested that discounted prices had attracted deeper-pocketed participants.

Also Read: Why Thieves Targeted Bonk, But Solana Took The Biggest Hit In The Upbit Breach The rebound had immediate consequences across the derivatives market.

Why It Matters

Data from Coinglass shows that roughly $348.3 million in leveraged positions were liquidated over a 24-hour period. Of that, $229.46 million came from long positions during the earlier decline, while an additional $118.86 million in shorts was wiped out once Bitcoin climbed back above $90,000.

Ethereum accounted for the largest share of liquidations at $135.14 million, and Bitcoin contributed $78.48 million.

The single largest liquidation, a $17.81 million ETH-USD position, occurred on Hyperliquid.

In total, 122,572 traders were liquidated as volatility caught both sides of the market off balance.

Short sellers, in particular, were forced out of positions as the rebound accelerated and prices moved rapidly higher.

Bitcoin’s recovery raises the question of whether the renewed momentum can sustain itself following its broader correction from $126,000.

Read Next: Google Introduces Titans, The First AI System To Update Its Own Memory In Real Time