As the global market digests political shocks and shifting investor moods, today’s spotlight falls on a highly polarized crypto landscape. Ethereum (ETH) soared on strong institutional backing and treasury accumulation, while meme coin MANYU crashed nearly 20% after a meteoric 30-day rise, confirming that retail exuberance can turn cold quickly. Solana (SOL) is heating up with promising ecosystem activity and a $600M on-chain ICO, while SPX6900 and FLOKI ride the memecoin resurgence wave with double-digit gains. The divergence between utility-driven assets and hype-led tokens paints a sharp picture of where the market is finding conviction and where it’s not.

Manyu (MANYU)

Price Change (24H): -19.38% Current Price: $0.072540

What happened today

MANYU plunged nearly 20% as investors locked in profits after a parabolic 1,362% 30-day rally. The sell-off follows fading hype from its July 14 roadmap reveal and prior exchange listings (KuCoin, BitMart). Despite the 68.88% spike in 24h volume, no fresh catalysts emerged to support the price. Meme coin sector weakness and rising Bitcoin dominance added pressure.

Market Cap: $25.4M 24-Hour Trading Volume: $14.81M Circulating Supply: 1P MANYU

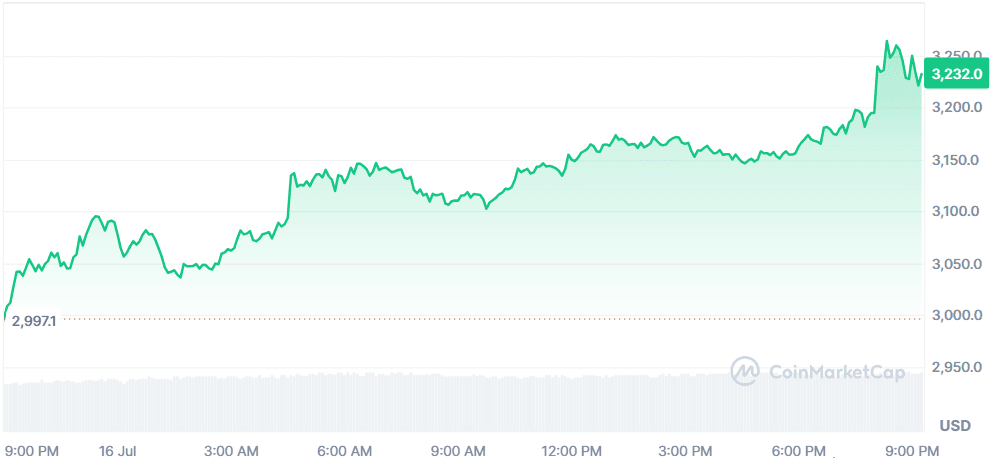

Ethereum (ETH)

Price Change (24H): +6.29% Current Price: $3,235.84

What happened today

Ethereum saw a strong price surge on the back of massive institutional demand. SharpLink Gaming added $225M in ETH to its treasury, while Wall Street interest continues rising post spot ETF approvals. Vitalik Buterin also emphasized Ethereum's L1 strength and quantum readiness. Ethereum remains the dominant force in staking, tokenized assets, and zk infrastructure development.

Market Cap: $390.61B 24-Hour Trading Volume: $38.54B Circulating Supply: 120.71M ETH

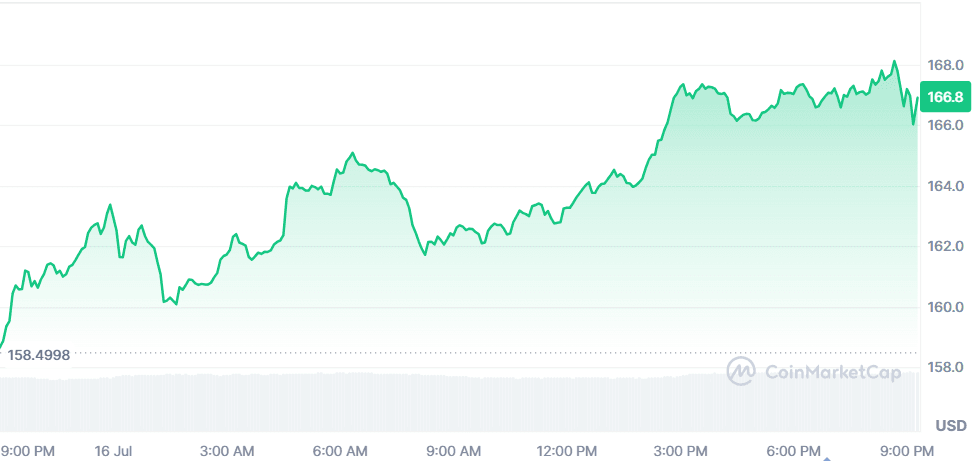

Solana (SOL)

Price Change (24H): +4.02% Current Price: $166.89

What happened today

Solana is gaining bullish momentum, testing the $165 resistance fueled by a string of ecosystem wins. Firedancer’s mainnet beta launch boosted validator speed by 600%, while Solana Pay integrations and Visa’s reward system added retail utility. The Pump.fun ICO raised $600M entirely on-chain, spotlighting Solana’s throughput and network confidence. Analysts eye a breakout toward $375–$400 if the technical triangle pattern confirms.

Market Cap: $89.49B 24-Hour Trading Volume: $6.71B Circulating Supply: 536.25M SOL

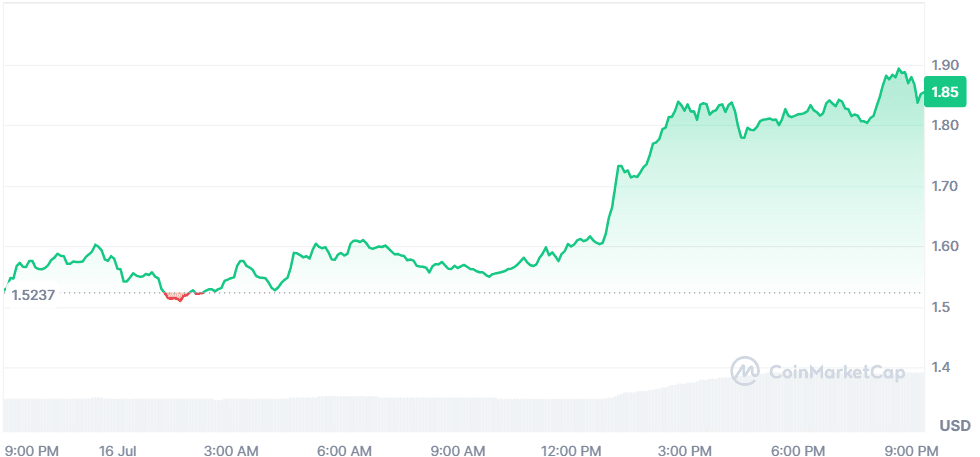

SPX6900 (SPX)

Price Change (24H): +17.95% Current Price: $1.85

What happened today

SPX6900 rallied nearly 18% as memecoin interest rebounded sharply. It cleared key resistance at $1.36, with RSI showing more room to run. A feature on the July 16 episode of “The Crypto Beat” helped brand it as a community focal point, fueling social engagement and speculative inflows. SPX outpaced peers like PEPE and BONK as altcoin season indicators turned bullish.

Market Cap: $1.72B 24-Hour Trading Volume: $169.53M Circulating Supply: 930.99M SPX

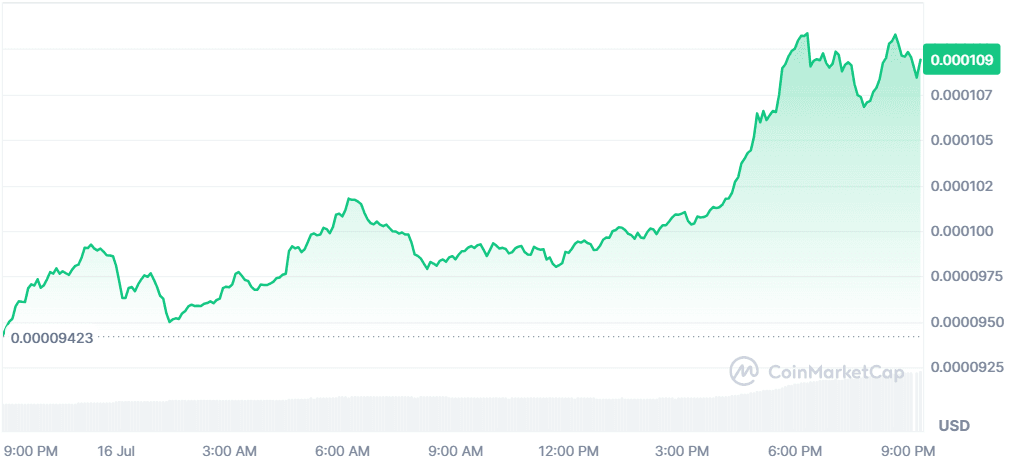

Floki (FLOKI)

Price Change (24H): +13.96% Current Price: $0.0001093

What happened today

FLOKI broke out from a descending channel, rising nearly 14% amid bullish chart signals and strong memecoin sector inflows. The Valhalla play-to-earn game hit 1M+ transactions on opBNB since July 1, driving renewed investor attention. A double-bottom pattern and positive MACD crossover supported technical upside. Reduced exchange supply added fuel to the rally.

Market Cap: $1.04B 24-Hour Trading Volume: $259.1M Circulating Supply: 9.54T FLOKI

Global Market Snapshot

Markets were rattled mid-day as a White House official confirmed that President Donald Trump “likely will soon” fire Federal Reserve Chair Jerome Powell, a move that triggered immediate volatility across U.S. equities. While Trump later denied any imminent action, the S&P 500, Nasdaq, and Dow each dipped around 0.5% intraday before rebounding slightly. The central bank has faced weeks of criticism from the Trump administration over interest rates and inflation management, with recent PPI and CPI prints showing persistent price pressures. A Supreme Court ruling has already complicated Trump’s path to ousting Powell, yet political pressure is mounting after Tuesday’s crypto legislation clash in Congress.

Meanwhile, optimism returned to the crypto sector after Trump claimed that previously stalling House Republicans now support advancing the GENIUS Act. Bitcoin climbed above $119K while Ethereum surged 5.5%, further supported by institutional inflows and treasury buys. In Europe, the EU unveiled a proposed €2 trillion budget for 2028 - 2034, earmarking €131 billion for defense and €100 billion for Ukraine. While the budget marks a milestone in scope, critics argue it still falls short of addressing the bloc’s full investment needs. Markets now brace for potential fallout from U.S.–EU tariff tensions, Fed independence concerns, and rising volatility across asset classes.

Closing Thoughts

Investor sentiment today is caught between political turbulence and opportunistic optimism. The broader financial market was briefly shaken by reports that Trump intends to fire Fed Chair Powell, only to bounce back once denial headlines emerged. Yet that flash of uncertainty underscored just how fragile confidence in macro policy remains. Meanwhile, European stocks are trading cautiously amid fresh tariff concerns and a massive but controversial €2T EU budget proposal, one that could reshape defense and digital investments for the bloc.

Traditional equities saw some green, especially in healthcare and banking, but volatility signals suggest more instability may lie ahead.

In crypto, there’s a noticeable split forming. Institutional-grade assets like Ethereum are seeing aggressive accumulation from treasury buyers and ETF-driven demand. On the other hand, memecoins, while still showing explosive short-term returns, are proving much more vulnerable to sentiment shifts and narrative exhaustion, as seen with MANYU’s sharp decline. SOL stands out as a hybrid play, with strong fundamentals meeting retail momentum. For now, the action favors coins with a blend of utility, liquidity, and narrative strength memes may still pump, but fundamentals are starting to reclaim the wheel.