Amid a sharp sell-off in global equities and a surge in oil prices, crypto markets mirrored broader market volatility but showed selective strength. Safe-haven demand drove PAXG higher, XRP saw renewed corporate interest despite legal overhangs, and AB surged on fresh Bitcoin-aligned corporate treasury plays.

Meanwhile, BTC slipped under macro pressure, and WCT extended its recent correction as capital rotated out of altcoins. Risk sentiment is shifting fast and today’s top coins reflected exactly where that capital is moving.

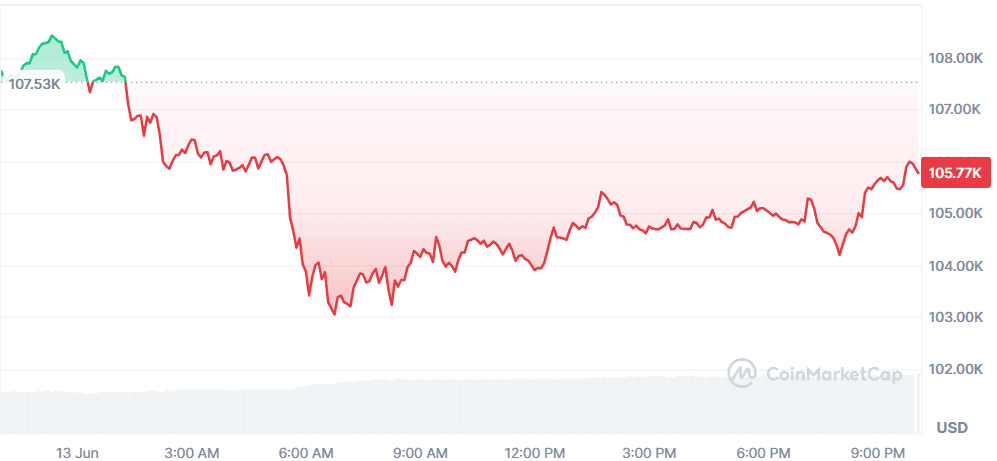

Bitcoin (BTC)

Price Change (24H): -1.95% Current Price: $105,521.62

What happened today

Bitcoin faced significant selling pressure today amid heightened geopolitical tensions. Israel’s airstrikes on Iran triggered a global risk-off sentiment, with Bitcoin falling 2% in an hour and seeing nearly $1B in long liquidations. Despite this, institutional confidence remained strong as Bitcoin ETFs recorded $970M in inflows over three days, a reversal from weeks of outflows. Separately, Brazil’s potential allocation of 5% of sovereign reserves to Bitcoin stirred bullish debate, signaling growing global adoption potential.

Market Cap: $2.09T 24-Hour Trading Volume: $73.26B Circulating Supply: 19.87M BTC

AB (AB)

Price Change (24H): +4.14% Current Price: $0.01205

What happened today

AB saw renewed bullish interest following H100 Group AB’s $10.6M raise aimed at building a Bitcoin-focused treasury. The move, spearheaded by institutional investor Adam Back, sparked a 45% rally in H100’s stock and reflected a growing trend of Scandinavian corporates adopting crypto treasury strategies. This enthusiasm spilled over to AB’s token, as market participants speculated on broader crypto-alignment plays in the Nordic market.

Market Cap: $758.13M 24-Hour Trading Volume: $299.42M Circulating Supply: 62.86B AB

PAX Gold (PAXG)

Price Change (24H): +1.38% Current Price: $3,451.03

What happened today

PAXG surged as geopolitical tensions sent investors flocking to safe-haven assets. The escalation between Israel and Iran triggered a spike in gold prices and by extension, PAXG. A breakout above technical resistance and a 196% surge in trading volume reinforced bullish sentiment. The rise underscored gold’s continued appeal over risk assets, with PAXG outperforming major cryptos like BTC and ETH during this risk-off wave.

Market Cap: $835.55M 24-Hour Trading Volume: $221.33M Circulating Supply: 242.11K PAXG

WalletConnect Token (WCT)

Price Change (24H): -4.71% Current Price: $0.3804

What happened today

WCT extended its post-airdrop correction, shedding nearly 4% today amid profit-taking and broad altcoin weakness. The token has fallen 46% from its recent peak, with today’s move exacerbated by declining liquidity (26% volume drop) and Bitcoin dominance rising to 63.88%. Altcoins in general saw outflows as capital rotated to safer bets, and WCT’s thin order books magnified the downside move.

Market Cap: $70.84M 24-Hour Trading Volume: $124.8M Circulating Supply: 186.2M WCT

XRP (XRP)

Price Change (24H): -4.54% Current Price: $2.14

What happened today

XRP declined as Ripple and the SEC neared a potential settlement, requesting court approval to release $125M in penalties. While the legal resolution offers longer-term clarity, today’s price action reflected short-term uncertainty and profit-taking after corporate treasury announcements involving XRP ($986M commitments). Broader market jitters also weighed on XRP, with traders locking in gains amid the ongoing geopolitical volatility.

Market Cap: $126.05B 24-Hour Trading Volume: $4.66B Circulating Supply: 58.81B XRP

Global Market Snapshot

Global markets tumbled on Friday as Israel’s airstrikes on Iran triggered a broad risk-off move across equities and commodities. The Dow Jones fell 437 points (-1%), while the S&P 500 dropped 0.3% and the Nasdaq lost 0.4%, pressured by rising oil prices and geopolitical fears. European stocks also sank, with Germany’s DAX and France’s CAC 40 both down ~1.1%, and the UK’s FTSE 100 off 0.5%.

Brent crude surged 6% to $75+, lifting energy stocks sharply higher. Defense stocks outperformed, with Lockheed Martin and RTX gaining over 3-4%, while travel and airline shares plunged as oil spiked and Tel Aviv flights were disrupted. Payment stocks like Visa and Mastercard dropped ~4% amid reports of potential stablecoin competition from Amazon and Walmart.

Meanwhile, US consumer sentiment showed a surprise rebound, easing some inflation fears despite geopolitical uncertainty. The dollar index strengthened 0.2% as investors sought safety, adding pressure on risk assets globally.

Closing Thoughts

Investor sentiment across both crypto and traditional finance markets today was shaped almost entirely by geopolitical risk. Safe-haven plays outperformed like gold, gold-backed tokens like PAXG, and defense stocks were bid aggressively, while equities broadly fell and oil spiked. In crypto, XRP’s treasury-driven bid suggests corporate buyers remain active even in risk-off environments, while BTC faced systematic de-risking. Altcoins like WCT showed the first signs of liquidity stress, underscoring the defensive posture traders are adopting.

For now, capital is flowing toward perceived safety, whether in commodities, stable assets, or large-cap tokens with institutional narratives. Memecoins and speculative plays remain on the sidelines as participants digest macro volatility. Heading into the weekend, whether BTC finds footing and whether PAXG holds its breakout will likely signal how deep this risk-off cycle runs in the days ahead.