After years of inflated narratives and rally-driven speculation, many investors are sitting on tokens that no longer have a realistic path forward. These coins were born in the bull run but failed to grow beyond it. As the market shifts toward utility-driven, institutional-ready protocols, it is time to clear the clutter and focus on coins that are still building, still relevant, and still worth holding.

Here are five cryptocurrencies that looked promising once but now deserve to be retired from your portfolio.

Gala and The Sandbox

No two tokens better represent the rise and fall of the Web3 gaming dream than Gala and The Sandbox. Both entered the scene promising to disrupt traditional gaming with blockchain-powered economies, player-owned assets, and immersive virtual experiences. Both attracted big names, raised millions, and launched high-profile events. And yet, both now sit at a fraction of their all-time highs with very little to show in terms of lasting adoption.

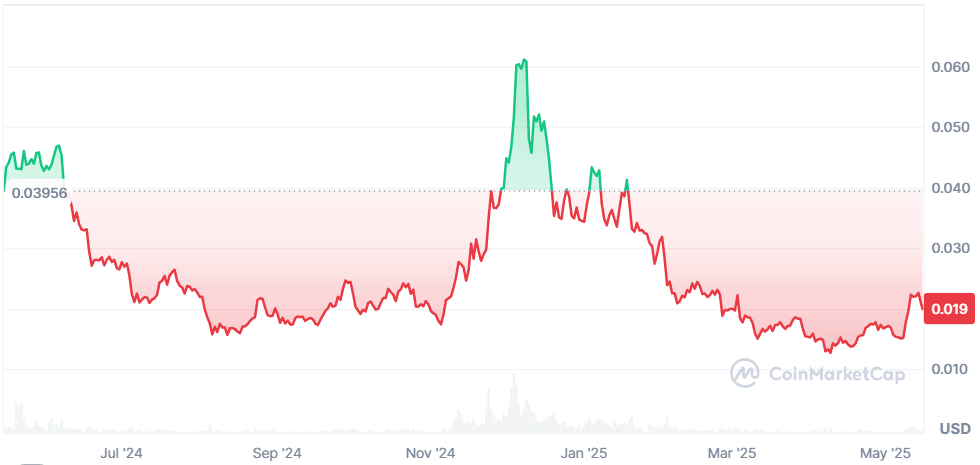

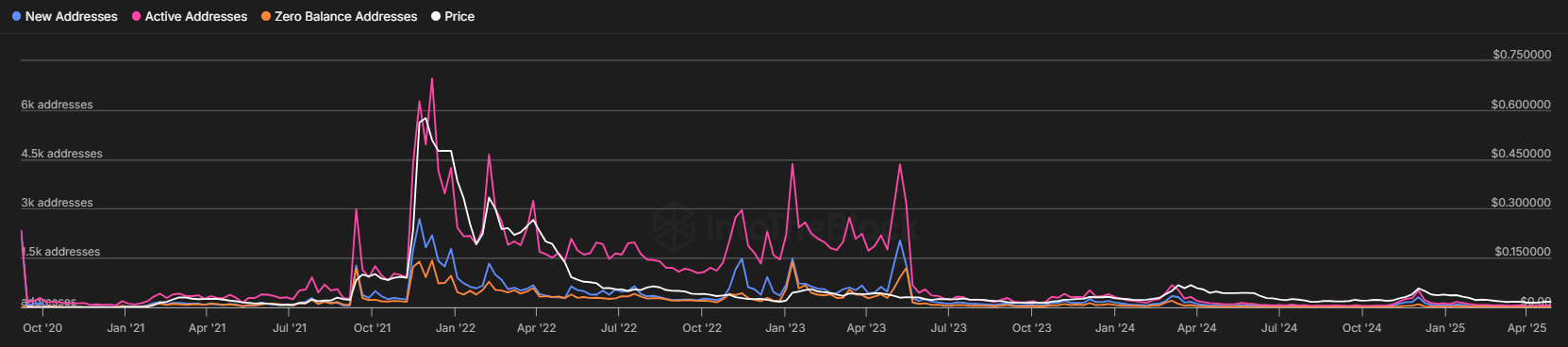

Gala, once seen as the Steam of Web3, soared during the peak of GameFi enthusiasm. At its highest, it traded above 70 cents. Today, it is barely above two cents. Recent activity like the Easter Egg Hunt in partnership with the White House did spark short-lived interest. Over 300,000 game sessions were logged and 100,000 new accounts created. But the token only gained 18 percent and quickly flattened out.

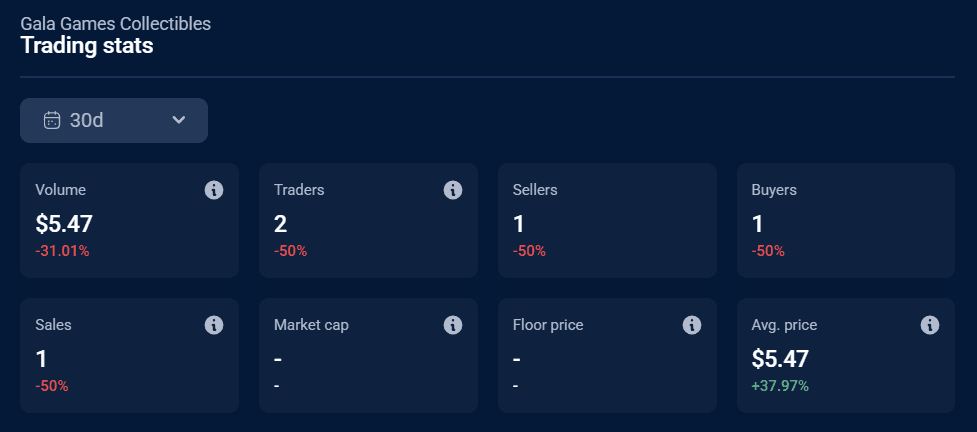

Gala’s own marketplace shows just how dire things are. In the past 30 days, only two traders moved a combined volume of $5.47. One item was sold. Active addresses sit around 55.

The platform's most public legal development is a bitter battle between its co-founders involving allegations of misused company funds and stolen tokens. The product pipeline continues but even successful events are failing to convert attention into real engagement. One of its flagship games, The Walking Dead: Empires, is shutting down this July.

The Sandbox followed a similar trajectory. It peaked during the metaverse mania with celebrity LAND sales, brand collaborations, and the promise of a new digital world. Alpha Season 4 in late 2024 seemed like a turnaround moment. Nearly 600,000 players participated, 49 million quests were completed, and over 1.4 million hours of gameplay were logged. Token price surged back to 94 cents. But as of May 2025, SAND trades at 32 cents.

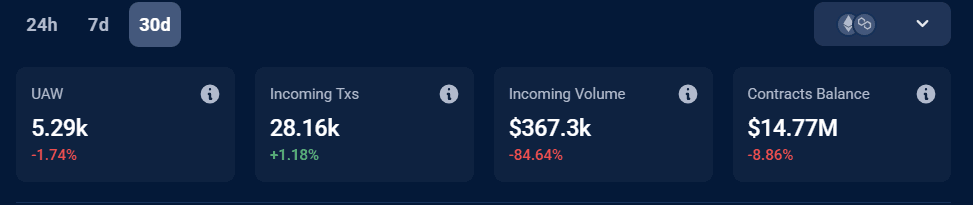

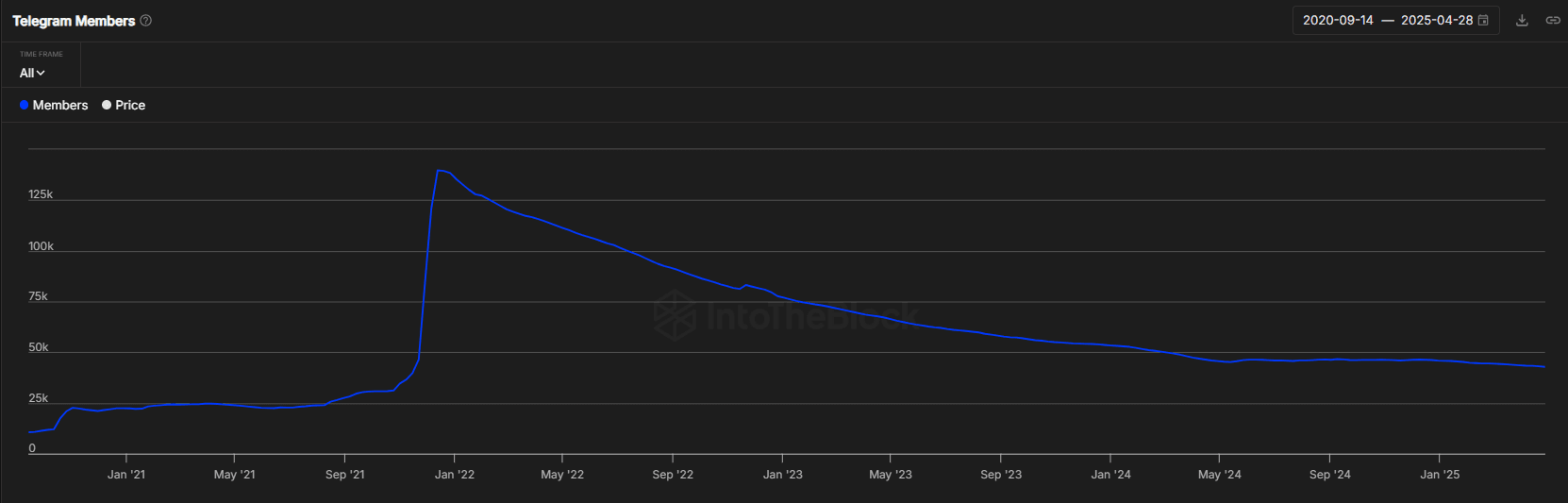

Unique active wallets have dropped to just over 5,000. Incoming volume has fallen by more than 84 percent. Marketplace activity has slowed, and non-LAND NFTs are priced so low they are functionally worthless. Telegram members have declined from a peak of 139,000 to just over 35,000.

Both projects continue to announce new partnerships. The Sandbox recently added [Jurassic Park](https://x.com/TSBCreators/status/1921567383631888393 and launched a new Snoop Dogg music drop. Gala is building mini-games and expanding GalaChain. But for investors, the signal is clear. Even with all t)he branding and promotional firepower, real players are not showing up. These platforms promised next-gen gaming but what they delivered looks like browser games from the early 2000s. Traditional gaming, powered by AI and multi-platform integration, has already pulled far ahead. Retail interest might occasionally spike around a flashy event but these tokens are no longer viable long-term holds.

Flow

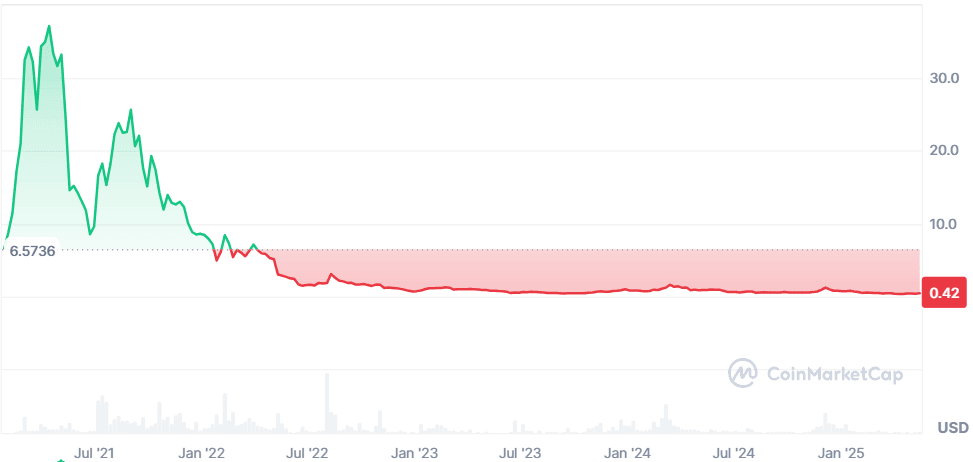

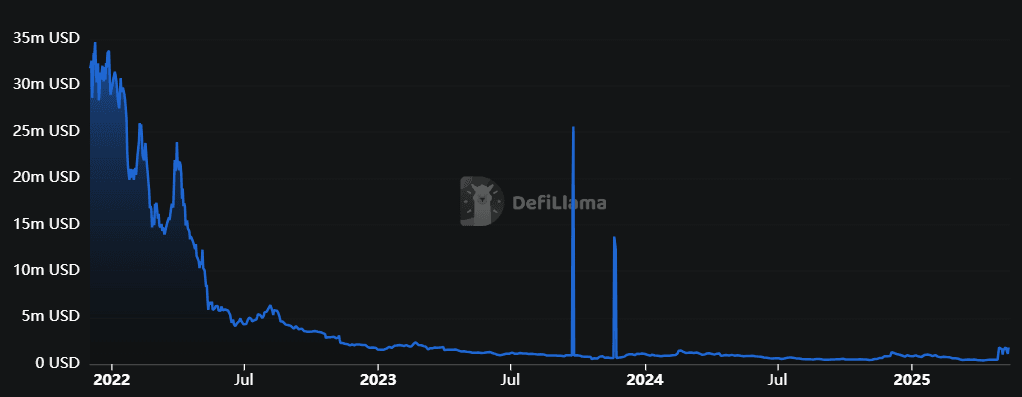

If you’ve been holding onto Flow hoping for a rebound, it’s time to reassess. Launched by Dapper Labs and known for powering NBA Top Shot, Flow was once at the center of the NFT boom. Its all-time high of over $37 came during the frenzy of 2021. Today, it trades at just $0.42, a staggering 94 percent decline. What’s more concerning is how little progress has followed the hype.

The platform has seen renewed chatter lately due to a $4 million settlement from a class-action lawsuit involving NBA Top Shot. Investors accused Dapper Labs of artificially inflating NFT prices by limiting withdrawals and centralizing control. The lawsuit’s core issue was whether the Top Shot Moments were unregistered securities. While the payout helps close that chapter, it also cements Flow’s identity as a project caught between legal ambiguity and centralized control. Even now, Dapper Labs remains the primary driver of its ecosystem. That lack of decentralization is a glaring weakness in a market moving rapidly toward permissionless infrastructure.

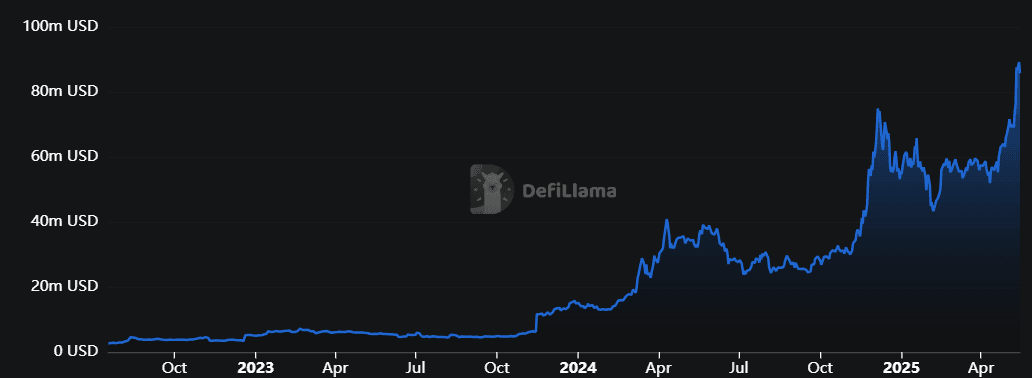

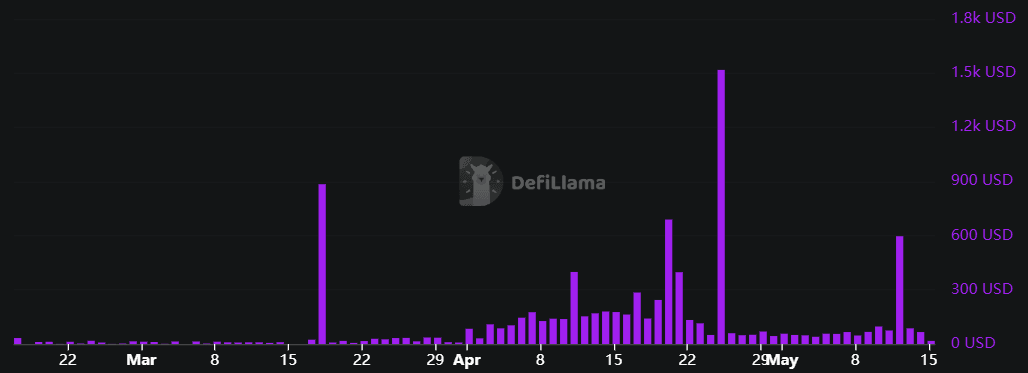

Looking at the numbers, the network is showing little promise of sustainable resurgence. Flow’s DeFi TVL is around $85 million. NFT volume in the last 24 hours is just over $9,000. App revenue as of May 15 was $17.

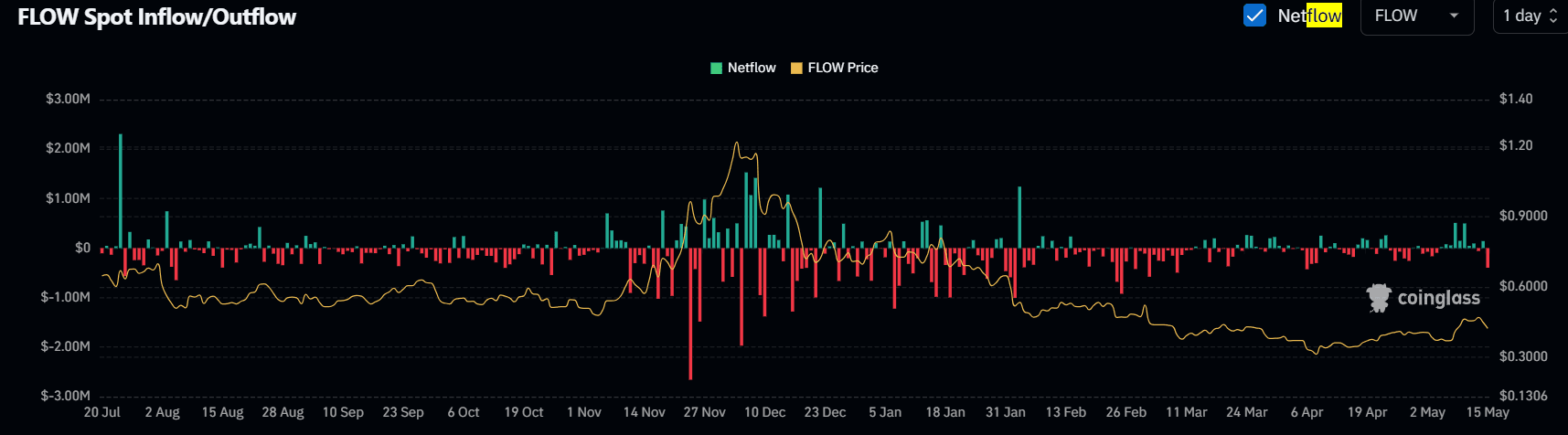

Spot netflow has remained negative, with recent outflows nearing $400,000 in a single day. It is true that price saw a temporary rise over the past month, but the rise is decoupled from any real on-chain strength. Most of the volume appears to be speculative, driven by rotation from retail rather than any new institutional interest.

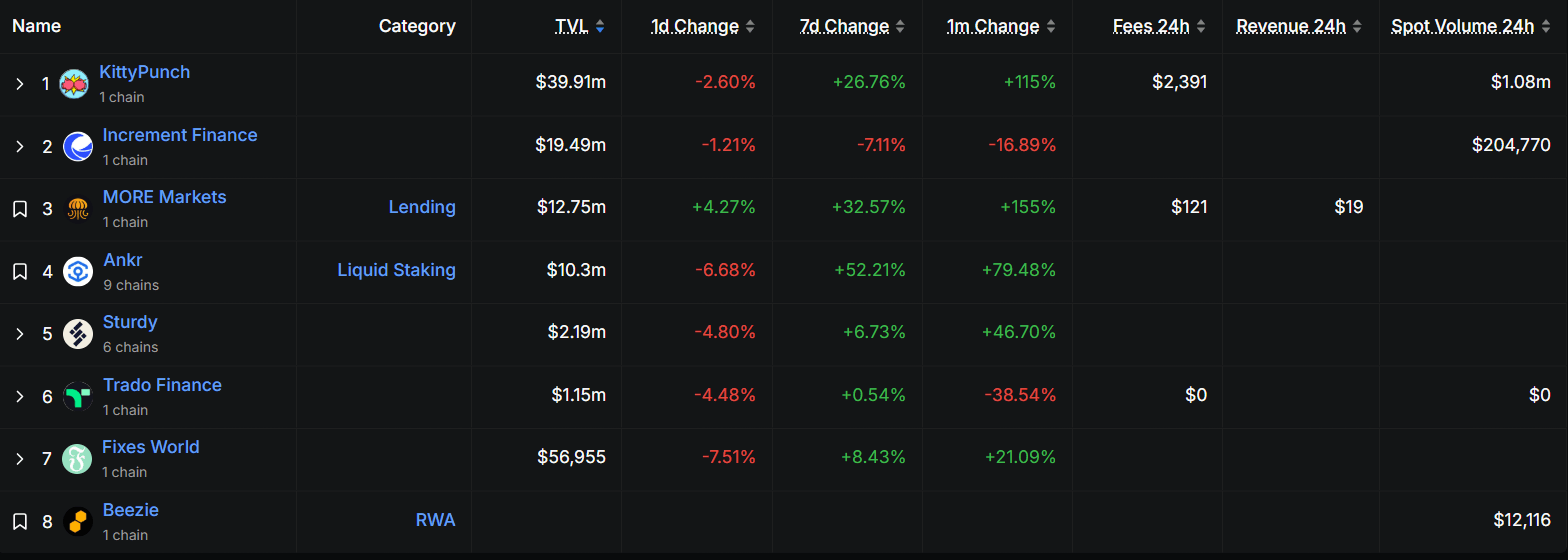

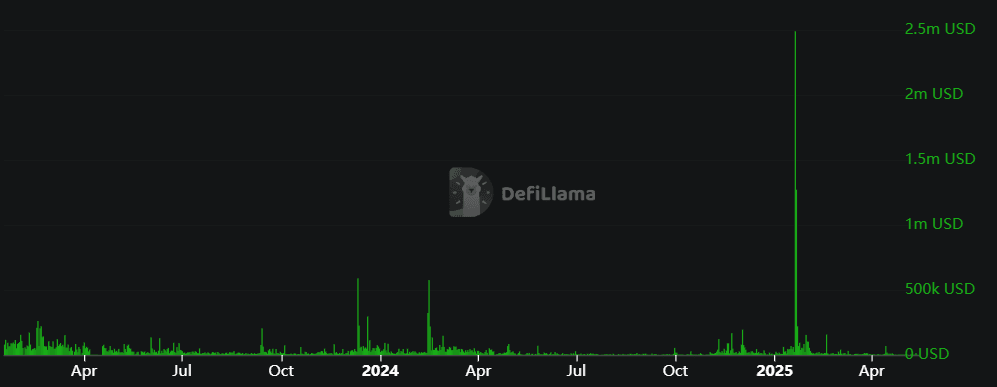

Even the broader DeFi ecosystem within Flow shows no standout activity. DEX volume across the chain is thin. Protocols building on Flow generate negligible revenue, with KittyPunch alone making up the majority of fee generation at just a few thousand dollars. A surge in FLOW price earlier this year was not supported by real inflows or protocol usage, and today, token activity has returned to pre-rally levels.

The excitement around Flow was once built on the belief that NFTs were going to onboard the next billion users. But that momentum has long dissipated. There is no major consumer app on Flow today seeing breakout success. Even the rumored return of CryptoKitties cannot justify holding onto a token with declining metrics, limited adoption, and no meaningful decentralization.

VeChain

On paper, VeChain is doing everything right. It just overhauled its GM NFT system, slashed upgrade costs, launched a vote-linked rewards model, credited early supporters, and laid out a structured roadmap for new NFT tiers all the way to December. It also snagged a MiCAR license, saw a 520% spike in development activity, and even added UFC President Dana White to its advisory board. From a compliance standpoint, it’s one of the few blockchains already aligned with Europe’s regulatory future.

But on-chain? It’s been radio silent.

VET is trading at $0.028, still down more than 90% from its ATH of $0.27. The total value locked across its DeFi ecosystem is an anemic $1.7 million, with DEX volume sitting at just $1,900.

Even during the recent spike in market cap past $2.4 billion, there’s been no breakout in token flows or trading activity.

The fundamentals are strong, there’s no denying that. VeChain’s tech, vision, and governance model are all solid. It’s hitting every note from ESG narratives to enterprise-grade tooling. But for all the updates and milestones, price action has stayed frozen, and there's little sign that institutional capital is circling. Retailers are mostly disinterested, and ecosystem buzz never quite escapes crypto Twitter.

So, while VeChain isn’t dying, it’s definitely deep in hibernation. Unless a major catalyst arrives (and no, tokenizing Tesla drives doesn’t count), this project might continue to live in a Schrödinger's state of “alive but forgotten” until a surprise resurrection occurs. Preferably involving incense, chants, and a miracle or two.

The Final Sweep

As we move deeper into 2025, it is time to ask a tough but necessary question: are you holding tokens from a bygone era or assets that still belong in the next cycle? Many of the projects that once felt like the future now feel like unfinished drafts of ideas that never quite landed. Gala, Sandbox, Flow, and VeChain each had their moment, but that moment has passed. What remains is a mix of stagnation, missed traction, and narratives that no longer resonate.

There is no glory in waiting forever. Crypto moves fast, and holding on to dead weight only slows you down. If the rest of this year is going to reward utility, actual usage, and fundamentals that show up on-chain, then it is time to clear the clutter. Sell in May and walk into the next season with tokens that still build, still matter, and still have a future.