Altcoin action stole the spotlight today as Magic Eden (ME), Railgun (RAIL), XION, Tellor (TRB), and Dego Finance (DEGO) dominated market chatter. From viral hype and controversial wallet partnerships to infrastructure breakthroughs and privacy endorsements, each of these tokens saw strong momentum.

Meanwhile, broader market unease following a disappointing U.S. private payrolls report seemed to push more eyes onto the crypto sector, especially coins offering innovation or narrative strength. It’s clear that while global equities wobble, crypto continues to churn with story-driven volatility.

Magic Eden (ME)

Price Change (24H): +18.13% Current Price: $1.01

What happened today

The ME token surged over 32% following hype around a so-called “Trump Wallet” promoted as a collaboration with Magic Eden. Trading volume skyrocketed 3,800%+, driven by promises of $1M in $TRUMP token rewards. However, chaos ensued as Donald Trump Jr. and Eric Trump publicly denied any affiliation, with threats of legal action and the promo account being suspended. The event sparked volatility and suspicion, ending the day with ME up 19% but trending downward due to manipulation concerns.

Market Cap: $152.82M 24-Hour Trading Volume: $582.88M Circulating Supply: 150.09M ME

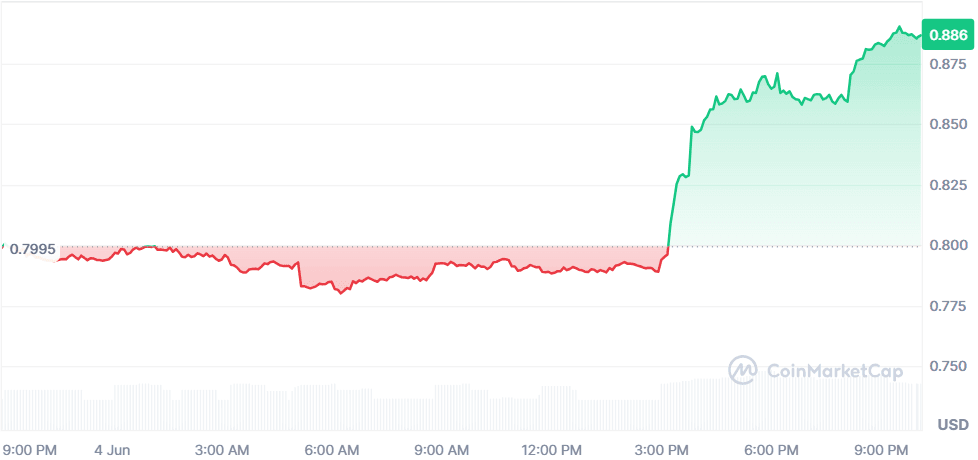

Railgun (RAIL)

Price Change (24H): +11.68% Current Price: $0.8864

What happened today

Railgun surged after another strong monthly update, showing over $140M in shielded volume and $300K+ in protocol fees for the 13th consecutive month. A contributor recently spoke at EthPrague, further boosting visibility. Endorsements from Vitalik Buterin and the Ethereum Foundation also amplified trust and adoption. Despite past rumors, leading crypto figures clarified Railgun is not associated with illicit actors, reinforcing its legitimacy as the leading on-chain privacy protocol.

Market Cap: $50.95M 24-Hour Trading Volume: $279.66K Circulating Supply: 57.5M RAIL

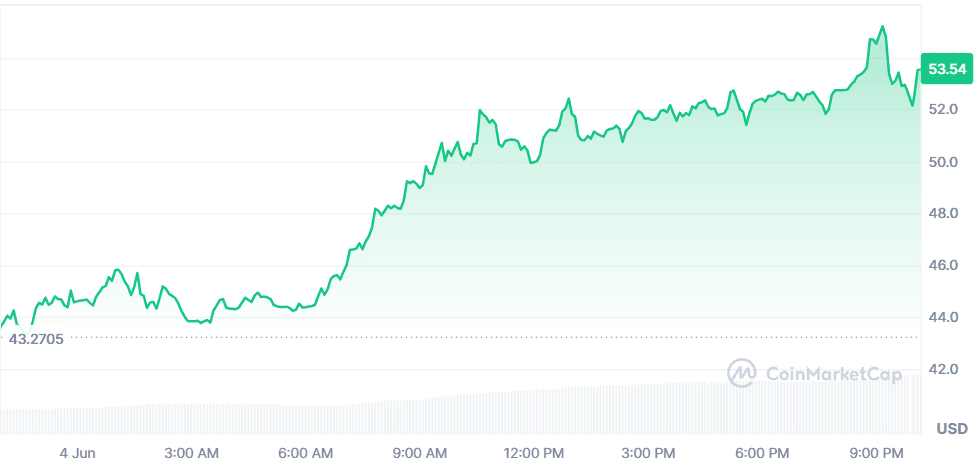

Tellor (TRB)

Price Change (24H): +21.81% Current Price: $53.65

What happened today

Tellor spiked significantly, continuing a steady upward trend without a clear single catalyst. The project, which focuses on decentralized oracles, has been seeing increasing on-chain activity and investor interest. Market optimism around on-chain data protocols in general, possibly fueled by Ethereum ecosystem developments, likely contributed to today’s 21.81% surge.

Market Cap: $143.49M 24-Hour Trading Volume: $320.37M Circulating Supply: 2.67M TRB

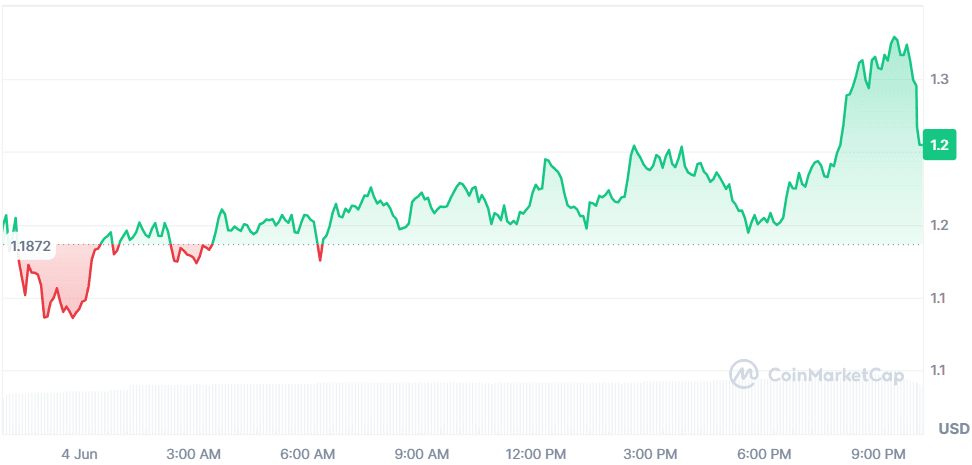

XION (XION)

Price Change (24H): +5.57% Current Price: $1.25

What happened today

XION gained momentum after launching “Dave,” a mobile dev kit targeting 18M mobile developers globally. The kit offers seamless iOS and Android integration for blockchain-powered apps eliminating the need for external wallets. The timing aligns with recent regulatory wins for crypto payments on mobile platforms. XION’s frictionless infrastructure is well-positioned to accelerate mainstream Web3 adoption, and the market responded positively to this innovation.

Market Cap: $42.63M 24-Hour Trading Volume: $16.98M Circulating Supply: 33.97M XION

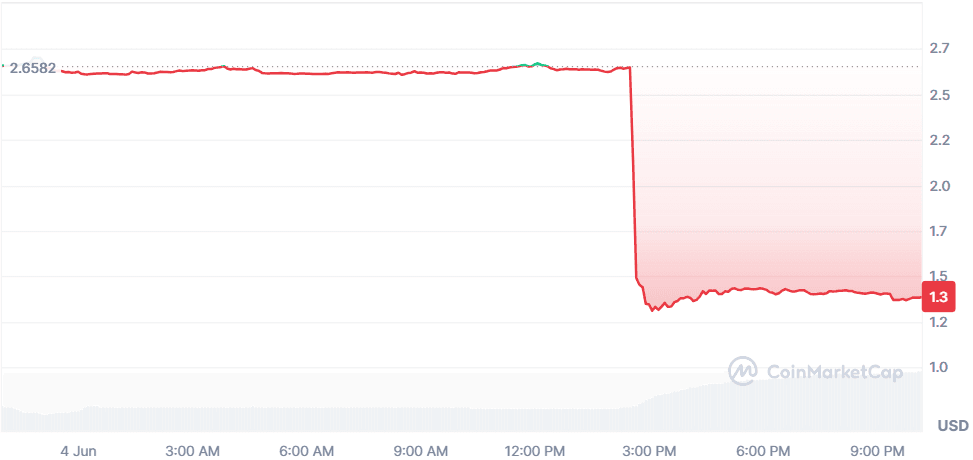

Dego Finance (DEGO)

Price Change (24H): -47.90% Current Price: $1.38

What happened today

DEGO suffered a dramatic 47.90% crash despite announcing support for USD1 liquidity on BNB Chain. The token was dragged down by over $650K in liquidations and massive selloffs over $250K worth of DEGO was moved to exchanges. With similarities to Mantra’s collapse, community concerns over a potential rug pull and skepticism around its tie-in with Trump’s World Liberty Financial further spooked investors. Technical indicators turned bearish, pointing to potential further declines.

Market Cap: $29.07M 24-Hour Trading Volume: $83.56M Circulating Supply: 20.99M DEGO

Global Market Snapshot

Private equity sentiment is shifting fast as Europe emerges as a top investment hotspot, stealing some thunder from the U.S. at Berlin’s SuperReturn conference. Political stability, deregulation momentum, and a €500B German fiscal package are fueling optimism, with major firms like Ares and Blackstone signaling increased exposure to European markets. While appetite from institutional investors remains cautious, key sectors like digital infrastructure and defense are drawing attention. Still, skepticism lingers due to Europe's fragmented nature and higher entry barriers which mean capital reallocations may remain modest for now.

Meanwhile, U.S. markets hovered near flat after ADP data showed the slowest private hiring in over two years, just 37,000 jobs in May versus 110,000 expected. Weak labor data, renewed tariff fears, and mixed signals from ISM services and consumer spending have left Wall Street in a holding pattern. President Trump’s tariff hikes and public calls for Fed rate cuts added to the volatility. Despite this, optimism endures in pockets, tech stocks like Nvidia continue to lead gains, and Wells Fargo’s removal from the Fed asset cap unlocked fresh upside for the banking sector.

Closing Thoughts

Investor sentiment in traditional markets remains cautious as weak labor data and rising trade tensions keep U.S. indices in a narrow range. Traders appear to be waiting for clarity from Friday’s payroll numbers or a firmer policy direction from the Fed, especially with Trump’s tariffs back in play. Equities like Nvidia and Wells Fargo managed to stand out, but the broader picture suggests fatigue and uncertainty, especially in consumer and industrial segments.

In contrast, crypto markets are pulsing with activity—whether it's Magic Eden riding the meme-fueled frenzy (despite legal backlash), Railgun leading the privacy revolution, or XION quietly building mobile-native Web3 infrastructure. The divide between risk-aversion in equities and risk appetite in crypto feels especially stark today. Narrative coins are attracting both capital and community attention, proving once again that in crypto, sentiment shifts fast—and capital follows.Altcoin action stole the spotlight today as Magic Eden (ME), Railgun (RAIL), XION, Tellor (TRB), and Dego Finance (DEGO) dominated market chatter. From viral hype and controversial wallet partnerships to infrastructure breakthroughs and privacy endorsements, each of these tokens saw strong momentum—up or down. Meanwhile, broader market unease following a disappointing U.S. private payrolls report seemed to push more eyes onto the crypto sector, especially coins offering innovation or narrative strength. It’s clear that while global equities wobble, crypto continues to churn with story-driven volatility.