Following a flurry of listings, buybacks, and key utility rollouts, several altcoins have exploded in trading activity today. Lybra Finance (LBR) skyrocketed on news of final emissions and liquidity restoration, while Lorenzo Protocol’s (BANK) IDO frenzy triggered high demand and instant listings across major platforms.

Open Loot (OL) gained traction through its futures market debut, Threshold (T) fueled investor optimism with strategic restructuring and token buybacks, and Masa (MASA) continued its rise as an AI data infrastructure powerhouse within Bittensor's evolving ecosystem. These five tokens dominated attention with a mix of narrative strength, aggressive moves, and well-timed announcements.

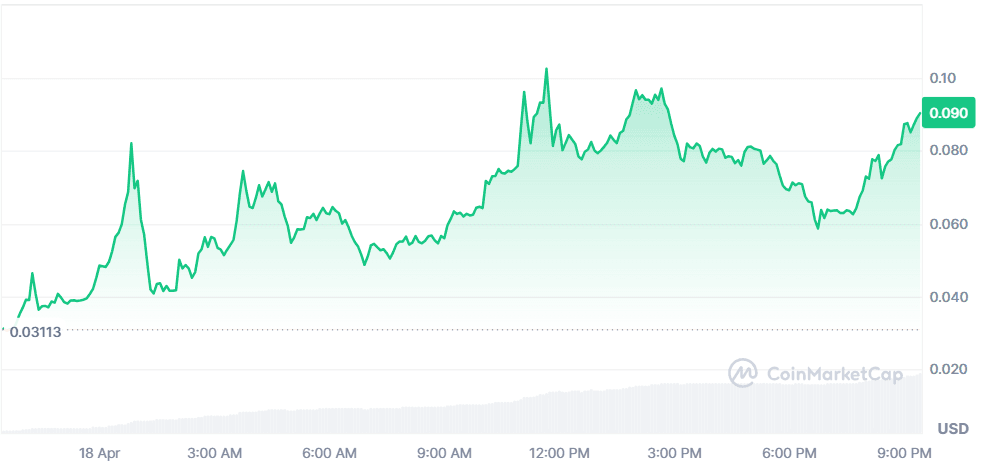

Lybra Finance (LBR)

Price Change (24H): +197.51% Current Price: $0.09012

What happened today

Lybra Finance surged following its major ecosystem update to resolve eUSD liquidity issues. The team burned 630k peUSD and unlocked the equivalent amount of eUSD, making it available for purchase via CowSwap at a fixed rate. These tokens were previously locked as protocol revenue. This liquidity maneuver is part of the protocol’s plan to wrap up its mining incentive program in a month as all LBR tokens reach full emission. The project also encourages users to check and claim remaining eUSD rewards from both V1 and V2.

Market Cap: $632.15K 24-Hour Trading Volume: $17.59M Circulating Supply: 6.96M LBR

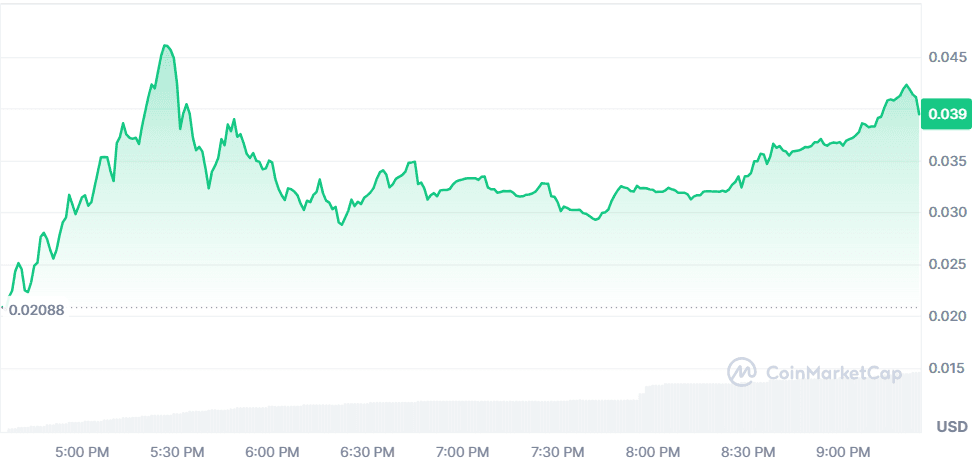

Lorenzo Protocol (BANK)

Price Change (24H): +89.35% Current Price: $0.03952

What happened today

BANK made its debut with a strong market entry. Its IDO concluded with massive success—oversubscribed by 18,329%, filling its funding target in under a minute. Binance Wallet hosted the public token sale and now supports trading via DEX and PancakeSwap. Listings followed rapidly across platforms like Bitget, which is also offering $100 airdrops for traders. As an institutional-grade yield-bearing platform with flagship BTC products like stBTC and enzoBTC, Lorenzo is attracting major attention.

Market Cap: $16.8M 24-Hour Trading Volume: $16.14M Circulating Supply: 425.25M BANK

Open Loot (OL)

Price Change (24H): +51.60% Current Price: $0.06123

What happened today

OL rallied sharply after it was listed for futures trading on Bitunix. The move indicates growing confidence in OL's long-term utility and exposure in derivative markets. With Open Loot continuing to expand its ecosystem, this listing may have catalyzed broader investor participation.

Market Cap: $22.87M 24-Hour Trading Volume: $34.92M Circulating Supply: 373.55M OL

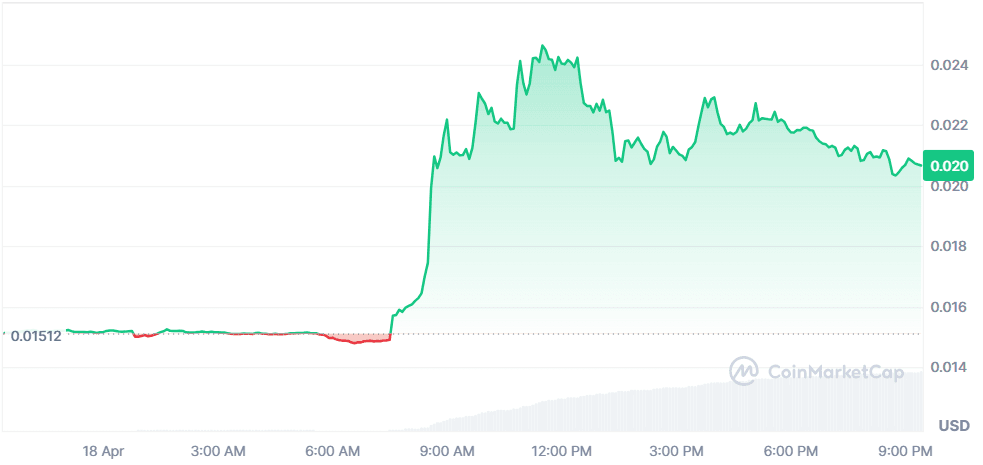

Threshold (T)

Price Change (24H): +36.49% Current Price: $0.02065

What happened today

Threshold Network announced a major restructuring under TIP-100 and TIP-103. Governance responsibilities have shifted to tLabs, significantly reducing annual costs by over $1.1 million. The DAO also initiated a strategic buyback of T tokens—worth around $7M—and halted treasury sales. These moves are expected to reduce sell pressure, enhance long-term value, and support DeFi growth. The network aims to strengthen TVL and tBTC usage while optimizing treasury operations with a 2–3 year runway secured.

Market Cap: $209.15M 24-Hour Trading Volume: $385.79M Circulating Supply: 10.12B T

Masa (MASA)

Price Change (24H): +41.33% Current Price: $0.02168

What happened today

MASA surged as the project expanded its visibility and utility within the AI x Web3 space. It launched its Trusted Execution Environment (TEE) on Bittensor Subnet 42 and joined the TAO Council. With new API dashboards, hackathons, sentiment tools, and live data scraping for X (Twitter), MASA is rapidly positioning itself as a critical infrastructure layer for AI developers, LLM applications, and decentralized data access.

Market Cap: $14.16M 24-Hour Trading Volume: $13.32M Circulating Supply: 652.99M MASA

Global Finance Snapshot

U.S. agricultural exports are showing a mixed forecast for the 2025-26 season, with soybeans and wheat trailing due to global competition, while corn remains relatively strong. New-crop export commitments are near multi-year lows, signaling caution in trade activity amidst geopolitical tensions.

Meanwhile, the Russian rouble surged over 40% YTD, driven by rising oil prices and speculation of easing U.S.-Russia tensions. Japan’s Nikkei closed its best week in three months, buoyed by optimism surrounding renewed U.S.-Japan and U.S.-EU trade negotiations. While crypto shows bullish momentum in select sectors, global finance remains in flux, shaped by trade deals and shifting commodity strategies.

Closing Thoughts

Today’s market signals a clear tilt toward infrastructure-focused and utility-driven projects. Coins tied to DeFi mechanics (like LBR and T), AI-data frameworks (like MASA), and high-yield asset platforms (like BANK) are drawing strong investor momentum.

Notably, governance revamps and buybacks—as seen with Threshold—are restoring long-term confidence, while well-executed launches like BANK’s are showcasing how powerful community participation and exchange support can be when perfectly timed. OL’s futures launch hints at growing derivative demand, pointing to rising institutional interest in newer tokens with market depth potential.

Beyond crypto, global financial sentiment is laced with cautious optimism. While U.S. agri-export outlooks remain mixed due to rising international competition, the Russian rouble’s unexpected surge and Japan’s best trading week in months show that macro-economic narratives are shifting fast. Crypto's bullish pulse today seems to echo that broader sentiment: not blindly euphoric, but confident—especially in sectors showing real movement and fundamental alignment.